Netflix shares surge; Qualcomm drops after outlook

Netflix shares surge; Qualcomm drops after outlook

6:21 PM ET 1/27/10

LOS ANGELES (MarketWatch) -- Shares of Netflix Inc. leaped nearly 15% late Wednesday after the online DVD-rental company issued a strong forecast for its current quarter, but a lackluster yearly sales outlook from Qualcomm Inc. spurred a drop in the wireless technology developer's shares.

Netflix (NFLX) shares jumped 14% to $58.01 in heavy trading as the company said it expects first-quarter earnings to come in between 47 cents to 58 cents a share on revenue of $490 million to $496 million. Analysts polled by FactSet Research are looking for earnings of 45 cents a share on sales of $486.8 million.

The company's fourth-quarter profit rose 36% to $31 million, or 56 cents a share, thanks in part to lower costs related to acquiring subscribers. Excluding stock-based compensation, Netflix would have earned 59 cents a share. Revenue rose 24% to $444.5 million. Analysts expected earnings of 49 cents a share on revenue of $446 million.

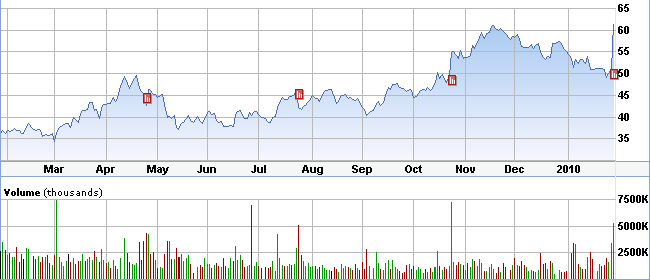

Shares of Qualcomm (QCOM) stumbled 9.9% to $42.55 and topped volume movers. The company said it expects revenue of $10.4 billion to $11 billion for fiscal-year 2010, falling short of the current estimate of $12.37 billion produced by a Thomson Reuters poll of analysts.

Earnings at Qualcomm jumped in its fiscal first quarter, to $841 million, or 50 cents a share, from $341 million, or 20 cents a share, in the same period last year. Earnings excluding items were 62 cents a share, above Wall Street's for earnings of 56 cents a share. Revenue at Qualcomm rose 6% to $2.67 billion. Analysts expected $2.7 billion.

Symantec Corp. (SYMC) issued a fourth-quarter forecast that came in line with Wall Street's expectations and swung to a profit for the third quarter, but investors still sent shares of the security software maker down 4% to $17.86.

Shares of LSI Corp. (LSI) were also in the red, down 5.8% at $5.65. The chip maker said it expects fiscal first-quarter earnings of 4 cents a share to 10 cents a share, with the lower end of the forecast below Wall Street's estimate of 6 cents a share.

But E-Trade Financial Corp. (ETFC) shares advanced, by 2.4% to $1.69 after the discount broker said it set aside $292 million to cover potential losses in the fourth quarter, less than $347 million set aside in the third quarter.

Ahead of the late session, U.S. stocks climbed higher in the wake of the Federal Reserve's decision to keep benchmark interest rates near zero. The S&P 500 Index $SPX rose 0.5%, the Dow Jones Industrial Average $INDU gained 42 points, or 0.4%, and the Nasdaq Composite (COMP) rose 0.8%.

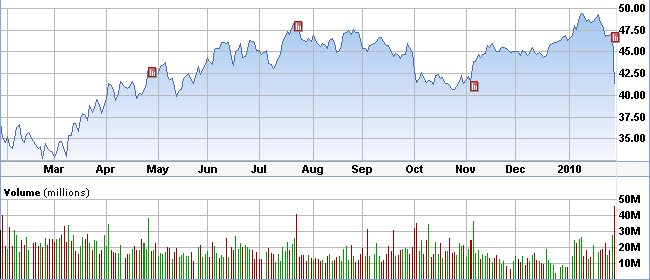

NFLX一年股价变化图