黄金急涨的真正含义:计价权失衡与无效GDP闭环

黄金急涨的真正含义:计价权失衡与无效GDP闭环

The Real Meaning Behind the Gold Price Surge

Pricing Power Imbalance and the Loop of Ineffective GDP

钱 宏(Archer Hong Qian)

2026年1月30日·Vancouver

统一前言:为什么我们必须重新思考“增长”的含义?

过去半个多世纪,人类文明几乎达成了一个隐含共识:只要经济规模在增长,问题终将被解决;只要 GDP 在上升,生活改善只是时间问题。

这一信念在工业文明的扩张阶段曾经奏效。它支撑了战后重建、基础设施铺展、全球贸易网络的形成,也为数十亿人口提供了脱离绝对贫困的现实路径。

然而,进入 21 世纪第二个十年后,这一共识开始系统性失灵。

越来越多的国家与社会同时经历着一种矛盾状态:宏观指标持续扩张,微观体感却持续收缩;规模能力不断增强,生活确定性却不断下降;金融资产与外汇储备屡创新高,家庭与社区却普遍感到紧张、脆弱与不安。

这些现象并非孤立事件,也并非单一国家的治理失败。它们跨越制度、文化与意识形态,呈现出高度相似的结构特征。

这迫使我们提出一个过去被刻意回避的问题:当“增长”本身不再自动带来生活改善,问题究竟出在分配环节,还是出在我们衡量成功的方式本身?

本组三篇文章,正是围绕这一问题展开。

第一篇从制度与文明层面,揭示“无效 GDP”如何通过债务、通胀与计价权,形成一个可自我维持的闭环;

第二篇通过外汇与购买力平价的结构分析,说明为何宏观规模优势并不会自然转化为普遍生活改善,反而可能外溢为国际层面的互害机制;

第三篇则尝试回答一个更具建设性、也更具挑战性的问题:如果问题不在增长本身,而在增长的价值参量,我们是否有可能改变这套参量?

这不是一组反增长、反市场、反全球化的文章。恰恰相反,它们试图为增长、市场与全球协作,寻找一种不再依赖透支未来与转嫁成本的继续存在方式。

有朋友说,过去几天,黄金价格出现了罕见的急剧拉升:在短短数个交易日内,黄金价格从4000多点迅速拉升至5600点附近。与这一异常波动相伴随的,是美元在高利率和名义强势表象之下,其实际购买力持续走弱的长期趋势。他进一步分析说,很多人把这理解为地缘政治紧张或市场避险情绪,但问题或许更深:当全球最重要的主权货币,越来越依赖通胀和贬值来“消化债务”,当市场开始用黄金这样的非债务资产对冲风险,我们是否已经站在一个货币制度的拐点上?

我已经注意到这一现象,黄金价格的“急涨”,不仅是避险情绪的体现,也不只是货币制度问题。避险情绪与货币制度背后,更深刻的原因,是当前国际金融体系中计价权博弈与实体经济效率之间发生的剧烈冲突。

这背后的原因是什么?共生经济学(Symbionomics)认为,“计价权博弈与实体经济效率”之间发生激剧冲突的背后,是人们(从个体到共同体)的政治经济组织行为的价值导向,出了大问题。仔细观察后不难发现,当今世界所有大大小小每一个问题的爆发,都是“无效GDP竞赛”惹的祸!

所以,针对这一现象解决问题的因应之道,并不是回到“金本位”,或更早的“银本位”,或当下势头很大的“数字稳定币本位”货币制度的拐点,而是要反思已经运行了八十多年,特别近50年来全球发展经济的价值参量,到了该改变(Transformation)的时候了。这就是,我为什么创作《从“黄昏”到“黎明”》的动机。

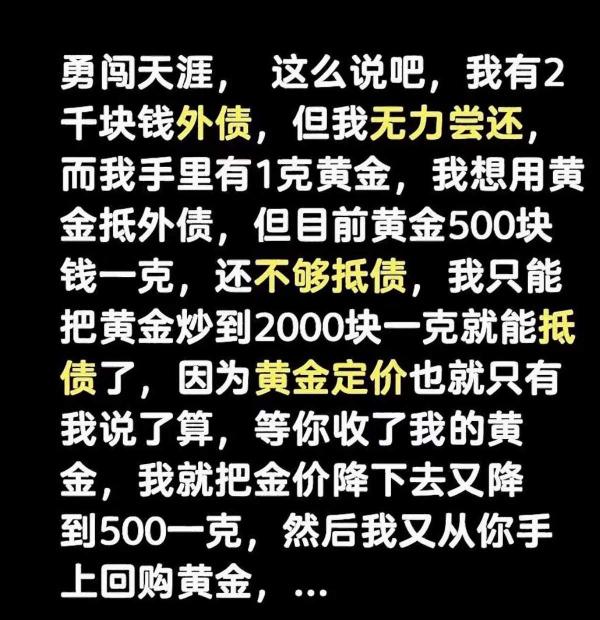

请看这张图说,它用一个极端但直观的比喻,讲清了一件常被误解的事:很多时候,债务问题不是“还不起”,而是“谁掌握计价尺度”。它并不需要阴谋论才能成立——只要存在定价权与清算规则的不对称,结构性剥夺就可能以“完全合法”的方式发生。

一、这张图在讲什么:不是骗术,是计价权

图中逻辑很简单:我欠你 2000(外债);我手里有 1 克黄金;金价现在 500/克,所以按现价我还不起。

于是我做三步:把金价抬到 2000/克,名义上 1 克黄金=2000;用黄金还债,账面债务清零;把金价再压回 500/克,然后再低价把黄金买回来。

最终结果是:债清了,黄金还在,债权人却被“洗劫”了一轮。

这不是靠违法实现的,而是靠“我能影响计价体系”的位置优势。所以,这张图真正要表达的,不是黄金本身,而是:

当一方掌握价值尺度(计价权)与结算规则(清算权)时,它可以通过名义价格变化,完成债务重组与资产再分配。

二、它影射的现实:主权货币 + 债务体系 + 规则权

把“黄金”换成更制度化的语言,就变成:

1.通胀阶段:抬高名义价格、稀释债务(“抹账”)

2.紧缩/通缩阶段:收回流动性、压低资产价格(“回收资产”)

3.资产重估:规则决定谁能续债、谁能融资、谁被迫贱卖

4.成本归宿:储蓄者、普通家庭、中产、劳动者、以及不具备规则制定能力的经济体承担代价

于是,一个看似市场波动的过程,呈现为可重复运作的制度闭环:

无效GDP → 债务扩张 → 通胀(抹账)→ 通缩(收割)→ 资产重估 → 资产回收 → 成本社会化 → 再制造无效GDP

这也解释了为什么最近这类内容被反复转发:当债务规模难以通过真实效率与真实福祉来消化时,市场会本能地转向黄金、实物资产等“非债务资产”,不是因为迷信,而是因为它们在制度波动里更不依赖“他人承诺”。

三、关键判断:问题不在“换锚”,在“值不值得”

因此,讨论不该落在“要不要金本位/银本位/稳定币本位”。因为,换锚不等于换价值观:如果仍然允许“做了多少交易”,自动等同于“创造了多少价值”,那么,任何锚都可能被卷入同一套循环。

这里必须厘清两个最容易误解的概念:

1.购买力:在既定定价体系里完成交易的能力(能买、能付、能成交)

2.价值:对未来福祉、生产能力、社会稳定、生态可持续的正向贡献

所谓“无效GDP”(Ineffective GDP),不是没钱、不是不存在购买力,而是:

它有购买力,却不创造可持续偿付能力;它花的是真钱,但它透支的却是未来。

重复建设、过度行政、军备竞赛、以福利维稳,替代赋能——都可能“拉动GDP”,但对长期福祉与生态修复贡献很有限,甚至为负。恰恰因为它们当下能成交、能动员资源,才最容易成为债务与泡沫的燃料。

四、为什么这会牵动“生活方式的再选择”

在“爱之智慧”的视角里,真正的问题不是某个国家、某个群体或个人“更坏”,而是:

我们把什么当成了成功的尺度。

当“做了多少”压倒“值不值得”,制度就会鼓励一种生活方式:

1.更快的扩张

2.更大的动员

3.更强的消耗

4.更激进的透支未来

而个人、家庭与社会的幸福感、健康、尊严、生态修复,却被推迟到“以后再说”,最后只能用通胀/通缩来完成“事后清算”。

所以,这不是金融技术问题,不是货币制度问题,而是文明的价值核算问题:我们到底在用什么指标决定什么值得被承认、被计价、被清算?

五、转型方向:从GDP到“价值过滤”的GDE新参量

我们不禁要问:无效GDP 增长的能耗浪费转化为货币债务,都去哪了?很显然,去了无意义的福利养懒人、去了寻租者(机构及官僚)的腰包、去了“无效投资”“外援”和无效国际机构、无良国家……还有呢?

多半成了马斯克“政府效率部”所指出的低效、浪费、欺诈行为赖以存在东西……在这个意义上,我们不难理解,川普政府的“美国优先”政策,为何在国内要反“深层政府”、反“政治正确”、反“非法移民”(吃掉国民福利并制造社会混乱)、反“雁过拔毛”,还要通过《大美法案》、倡导“大健康保险计划”、为孩子们建立“Trump Account”,国际上要退出那么多“无效机构”,要盟友自立自强提高国防/GDP占比……

然而,美国国策的这一深刻转换,要能够被世人理解和接受的关键,不是继续比拼GDP增长的高低快慢,而是重建与这一转换相匹配的经济价值参量,比如国民效能总值GDE(Gross Domestic Efficiency / Gross Development of Ecology),包括对“无效GDP”增长进行价值过滤!

共生经济学提出的解决问题的切入点,或核心方案,是对GDP“降维”:

1.把 GDP 视作“原始输入流量”(发生了多少动员与交易)

2.引入效能系数 η(能源、社会福祉、生态三维)

3.用R = GDE / GDP转化比判据,对“GDP增长”进行价值过滤:只有能改善生命质量与可持续性的活动,才算文明意义上的增长

衡量一个经济体一个国家是在透支未来,还是在创造可持续价值的思路,这又反过来证明,世界亟需这一套全新的GDE价值参量,引入“六大资源资产负债表+生产–交换–生活三重逻辑”,把加法思维的GDP从“终极目标”降维(做减法)为“原始输入流量”,并通过效能系数η(包含能源、社会福祉与生態三维)进行乘法过滤:

GDE=Σ(GDPi ×ηi)

这意味着制度不再依赖“通胀抹账 + 通缩回收”的双向阶段工具,来维持表面稳定,因为失败不再能被权力精英、资本精英与知识精英联盟无限货币化、无限延期、无限转嫁。

黄金涨的不是价格,反映的远不是避险情绪和货币制度转变的诉求,而是反映价值参量的系统性失灵,是对“价值核算失真”的不信任;货币问题从来不只是货币问题,而是我们把“做了多少”当真理,把“值不值得”交给通胀与通缩去解决。

统一结语:当记账方式改变,文明的方向才会改变

回看这组三篇讨论,可以发现一个贯穿始终的判断:

当一个文明把“发生了多少交易”当作终极真理,它迟早会用规模掩盖代价,用未来抵押当下,用他人的不稳定换取自己的暂时平衡。

无论是无效 GDP 的反复累积,还是外汇与购买力被集中使用、难以普惠生活,抑或国际关系中不断加剧的不信任与投机行为,其深层原因都指向同一件事:

我们长期缺乏一套能够区分“价值创造”与“价值稀释”的制度性机制。

在这种情况下,通胀与通缩会被反复用作技术性工具,债务会被不断延期与滚动,资产与风险会被持续重估与转移,而生活成本与不确定性,则被系统性地压向家庭、社区与未来世代。

共生经济学提出的 GDE(生態发展总值 / 国民效能总值),并非一种完美方案,也不是现行体系的简单替代品。它的真正意义,在于把“增长是否值得”这一问题,重新引入制度核心。

当 GDP 从终极目标降维为原始输入,当效能、福祉与生态成为必须被计入的价值参数,增长才第一次被要求对生命本身负责,而不仅仅对账面负责。

这种转变不会一蹴而就,也不可能没有阻力。但历史一再证明:真正决定文明走向的,从来不是资源是否充足,而是记账方式是否诚实。

当一个社会开始认真区分哪些增长值得被延续,哪些繁荣只是推迟的代价,文明的方向,才会真正发生改变。

这,或许正是我们此刻最需要的,不是更快的扩张,而是一次关于“什么值得被承认”的集体校准。

作者单位:Intersubjective Symbiosism Foundation·CANADA

The Real Meaning Behind the Gold Price Surge

Pricing Power Imbalance and the Loop of Ineffective GDP

Archer Hong Qian

January 30, 2026 · Vancouver

Intersubjective Symbiosism Foundation · Canada

Unified Preface

Why We Must Rethink the Meaning of “Growth”

For more than half a century, human civilization has operated under an implicit consensus:

as long as economic scale keeps expanding, problems will eventually be resolved;

as long as GDP continues to rise, improvements in living standards are merely a matter of time.

This belief once worked.

During the expansionary phase of industrial civilization, it supported post-war reconstruction, massive infrastructure buildout, and the formation of global trade networks. It also provided billions of people with a real pathway out of absolute poverty.

However, since the second decade of the 21st century, this consensus has begun to fail systematically.

More and more countries and societies are experiencing the same contradiction at once:

macroeconomic indicators continue to expand, while lived experience steadily contracts;

aggregate capacity grows stronger, yet life certainty declines;

financial assets and foreign exchange reserves reach record highs, while families and communities increasingly feel anxious, fragile, and insecure.

These phenomena are neither isolated events nor the result of governance failure in any single country.

They cut across political systems, cultures, and ideologies, exhibiting strikingly similar structural features.

This forces us to confront a question long avoided:

When “growth” no longer automatically translates into better living conditions,

is the problem merely one of distribution—or is it rooted in the way we measure success itself?

This three-part series is written around that question.

The first article examines, at the institutional and civilizational level, how ineffective GDP forms a self-sustaining loop through debt, inflation, and pricing power.

The second analyzes foreign exchange reserves and purchasing power parity, explaining why macro-scale advantages do not naturally translate into broadly improved living standards, but may instead spill over into a global mechanism of mutual harm.

The third asks a more constructive—and more challenging—question: if the problem lies not in growth itself but in its value parameters, can those parameters be changed?

This is not a set of anti-growth, anti-market, or anti-globalization essays.

On the contrary, it seeks a way for growth, markets, and global cooperation to continue without relying on the systematic depletion of the future or the transfer of costs onto others.

Gold’s Sudden Surge: A Symptom, Not the Cause

In recent days, gold prices have experienced an unusually sharp surge. Within just a few trading sessions, prices jumped from slightly above 4,000 to nearly 5,600. Alongside this abnormal movement lies a longer-term trend: despite high interest rates and apparent nominal strength, the U.S. dollar’s real purchasing power has continued to erode.

Many interpret this as a reaction to geopolitical tensions or a surge in risk aversion. But the issue may run deeper. When the world’s most important sovereign currency increasingly relies on inflation and depreciation to “digest” debt, and when markets turn to non-debt assets like gold to hedge risk, are we approaching a turning point in the monetary system itself?

I have been observing this phenomenon closely. Gold’s rapid rise is neither merely a reflection of risk sentiment nor simply a monetary issue. Beneath both lies a far more profound conflict: a sharp collision between pricing power within the international financial system and the real efficiency of the underlying economy.

From the perspective of Symbionomics, this collision reflects a deeper failure in the value orientation of political-economic organization—from individuals to entire societies. Upon closer inspection, it becomes difficult to deny that many of today’s crises, large and small, stem from a single root cause: the global competition in ineffective GDP.

Not a Return to the Gold Standard, but a Transformation of Value Parameters

The appropriate response, therefore, is not a return to the gold standard, an earlier silver standard, or today’s increasingly popular stablecoin-based regimes. Rather, it requires a re-examination of the value parameters that have governed global economic development for over eighty years—especially the last fifty—and an acknowledgment that they are due for transformation.

This is precisely the motivation behind my work From “Dusk” to “Dawn”.

Consider the following illustration. Using an extreme yet intuitive metaphor, it clarifies a point that is often misunderstood: many debt crises are not about the inability to repay, but about who controls the unit of account. No conspiracy theory is required. As long as pricing power and settlement rules are asymmetric, structural expropriation can occur entirely within legal frameworks.

I. What the Illustration Shows: Not Fraud, but Pricing Power

The logic is simple:

I owe you 2,000 units of external debt.

I own one gram of gold.

At the current price of 500 per gram, I cannot repay.

So I take three steps:

I push the gold price up to 2,000 per gram—nominally, one gram now equals the entire debt.

I repay the debt with that one gram of gold, clearing the liability on paper.

I then push the price back down to 500 and repurchase the gold cheaply.

The result:

the debt is gone, the gold is back in my possession, and the creditor has been “legally” stripped.

This outcome is not achieved through illegality, but through positional advantage within the pricing system. The illustration is not about gold itself; it is about this principle:

When one party controls both the unit of value (pricing power) and the rules of settlement (clearing power),

nominal price changes can be used to restructure debt and redistribute assets.

II. The Real-World Analogue: Sovereign Currency, Debt, and Rule Power

Translated into institutional terms, the process becomes:

Inflationary phase: nominal prices rise, diluting debt (“writing off” liabilities).

Tightening/deflationary phase: liquidity is withdrawn, asset prices are forced down (“asset recovery”).

Asset repricing: rules determine who can refinance, who can survive, and who must sell at a loss.

Cost absorption: savers, ordinary households, the middle class, workers, and economies without rule-making power bear the burden.

What appears to be market fluctuation reveals itself as a repeatable institutional loop:

Ineffective GDP → Debt Expansion → Inflation (Debt Dilution) → Deflation (Asset Harvesting) → Asset Repricing → Asset Reacquisition → Cost Socialization → New Ineffective GDP

This explains why such content circulates so widely today. When debt can no longer be absorbed through real efficiency or genuine welfare, markets instinctively turn toward gold and other non-debt assets—not out of superstition, but because these assets rely less on institutional promises.

III. The Core Judgment: The Issue Is Not the Anchor, but the Worth

Thus, the debate should not center on whether to adopt a gold standard, silver standard, or stablecoin standard. Changing the anchor does not change the value system. If “how much activity occurred” is still automatically equated with “how much value was created,” any anchor will be drawn into the same loop.

Two commonly confused concepts must be distinguished:

Purchasing power: the ability to complete transactions within a given pricing system.

Value: a positive contribution to future welfare, productive capacity, social stability, and ecological sustainability.

Ineffective GDP is not imaginary or powerless. It has purchasing power. But it fails to create sustainable repayment capacity. It spends real money while mortgaging the future.

Repeated construction, excessive administration, arms races, and welfare-for-stability programs may all boost GDP, yet contribute little—or even negatively—to long-term welfare and ecological repair. Precisely because they mobilize resources and generate transactions today, they become ideal fuel for debt and bubbles.

IV. Why This Forces a Reconsideration of Lifestyles

From the perspective of what I call the Amorsophia(wisdom of love), the problem is not that some countries or groups are inherently worse, but that we have chosen the wrong measure of success.

When “how much we do” overwhelms “whether it is worth doing,” institutions encourage a particular way of life:

faster expansion

greater mobilization

heavier consumption

more aggressive depletion of the future

Happiness, health, dignity, and ecological repair are postponed—until they reappear only as after-the-fact adjustments through inflation or deflation.

This is not a technical financial issue, nor merely a monetary one. It is a civilizational accounting problem:

What indicators decide what is recognized, priced, and settled?

V. The Direction of Transformation: From GDP to GDE as a Value Filter

Where does the wasted energy and resource consumption of ineffective GDP go once it is monetized as debt?

Into meaningless welfare schemes that disempower rather than enable;

into rent-seeking institutions and bureaucracies;

into ineffective investments, foreign aid, and dysfunctional international organizations;

and into practices of inefficiency, waste, and fraud—phenomena highlighted by initiatives such as Elon Musk’s so-called “government efficiency” efforts.

Seen this way, recent shifts in U.S. policy—from resisting the “deep state” and rent extraction to re-evaluating international commitments—become easier to understand. Yet the key to making such transformations intelligible and legitimate is not faster GDP growth, but the reconstruction of value parameters such as Gross Domestic Efficiency / Gross Development of Ecology (GDE).

Symbionomics proposes a clear pivot:

Treat GDP as a raw input flow.

Introduce an effectiveness coefficient η encompassing energy efficiency, social welfare, and ecological impact.

Use R = GDE / GDP as a filter: only activities that improve life quality and sustainability count as genuine growth.

Formally:

GDE = Σ (GDP? × η?)

This shift means that systems no longer rely on the dual tools of inflationary write-offs and deflationary recoveries to maintain superficial stability. Failure can no longer be endlessly monetized, postponed, or transferred by alliances of political, financial, and intellectual elites.

Gold is not rising because of fear alone, nor because of a longing for an old monetary regime.

It is rising because trust in distorted value accounting is eroding.

Monetary problems are never just monetary problems.

They arise when we treat “how much was done” as truth and delegate “whether it was worth doing” to inflation and deflation.

Unified Conclusion

When Accounting Changes, Civilization Changes

Across this three-part series, one conclusion recurs:

When a civilization treats the volume of transactions as ultimate truth, it will inevitably mask costs with scale, mortgage the future to stabilize the present, and trade others’ instability for its own temporary balance.

Whether in the accumulation of ineffective GDP, the concentration of purchasing power, or the rise of distrust and speculation in international relations, the underlying cause remains the same:

the absence of an institutional mechanism capable of distinguishing value creation from value dilution.

Under such conditions, inflation and deflation become technical tools, debt is endlessly rolled over, assets are repeatedly repriced, and the cost of adjustment is systematically pushed onto families, communities, and future generations.

GDE is neither a perfect solution nor a simple replacement. Its true significance lies in restoring a question long excluded from the core of economic governance:

Is this growth worth it?

When GDP is demoted from ultimate objective to raw input, and when efficiency, welfare, and ecology become explicit value parameters, growth is finally asked to answer to life itself—not merely to ledgers.

Such a transformation will not be easy, nor uncontested. Yet history shows that the direction of civilization is determined less by resource abundance than by the honesty of its accounting.

When societies begin to distinguish which growth deserves continuation and which prosperity merely defers its cost, the trajectory of civilization truly begins to change.