资源效能“转换率”——“宏观数据”与“微观体感”背离的破解之道

资源效能“转换率”

Resource Efficiency “Conversion Rate”

——“宏观数据”与“微观体感”背离的破解之道

—The Key to Resolving the Disconnect Between “Macro Data” and “Micro Experience”

钱宏(Archer Hong Qian)

2025年12月28日于温哥华

从朱永敏的“读书随感”说起

中国房地产和土地财政业内人士朱永敏,刚发来他的一则“读书随感”,准确抓住了当前中国经济中“宏观数据”与“微观体感”背离的核心矛盾,非常有洞察力。

官报2025年GDP增速超5%(姑且不较真有没有造假,如高善文说的2023、2024高估2个百分点),但百姓增收不明显的现象,本质上是“财富创造”与“数字增长”的脱节,即存在“无效GDP”。我们可以从经济学逻辑进一步深化朱永敏的这一观察。

在经济学语境下,GDP(国内生产总值)通常被分为“有效GDP”和“无效GDP”,这主要用于衡量经济增长的质量与可持续性。

有效 GDP (Effective GDP):指能够切实提升社会生产力、增加国民财富并改善人民生活水平的经济活动。

无效 GDP (Ineffective/Wasted GDP):指虽然在统计数据上贡献了数值,但实际上并未增加社会净财富,甚至造成资源浪费或负面影响的经济活动。

1. 从“会计恒等式”看钱去哪了?

GDP核算的支出法公式是:GDP = 消费 + 投资 + 政府支出 + 净出口。

朱随感观察: 2025年的增长很大程度上依然由“投资”和“政府支出”(如中西部基建、地级市高铁、大桥)拉动。

现实落差: 投资转化为“收入”需要一个前提——投资必须产生现金流回报。如果投资的是“无效GDP”(如杂草丛生的高铁站),那么这笔投入在建设期发完工人不高的工资后,就变成了沉淀的债务,无法在后续运营中产生利润来分红或加薪。钱“消失”在了一堆无法变现的钢筋混凝土里。

2. “无效GDP”是社会财富的减法

朱随感贵州大桥和负债4万亿的铁总,是典型的“跨时空错配”:

短期: 建设时雇佣工人、购买钢材,创造了光鲜的GDP数据和形象工程。

长期: 维护成本高于运营收益,政府和企业必须用未来的财政收入(税/费)去还过去的债。这意味着,为了填补“无效GDP”留下的财政负担,未来的国民收入被预支了。这也是为什么百姓感到收入不涨——因为社会创造的新财富中,很大一部分被拿去偿还旧账(除去寻租费)了。

3. 企业端的“内卷”与无效循环

刘元春教授提到的“生产过剩”和“内卷”,其实也是一种微观层面的无效GDP:

企业为了维持现金流,在利润极低甚至亏损的情况下疯狂生产。产值(GDP)上去了,但企业不赚钱,员工自然没法加薪。

这种“无利润增长”本质上是在消耗资本存量,而非创造社会增量。

4. “效益论证”是唯一的解药

朱随感呼吁的“从科学角度论证效益”,正是从“高速度增长”向“高质量发展”转型的核心:

有效GDP: 应该是能降低社会总成本的(比如能真正缩短通勤时间的地铁、能提高产业效率的5G基站)。

无效GDP: 则是增加社会总成本的(比如为了刷数据而建的远郊新城、利用率极低的高速公路、铁路和机场)。

5.发钱给百姓(准UBI)不合中国特色逻辑

最后,刘春元教授,特别是向松祚教授一再呼吁中国政府发钱的建议,不说是不是一种短期刺激手段,试图绕过结构性问题直接提升消费,但治标不治本的问题,就看朱随感中提到的“决策层”及“肉食者”,既缺少“资本主义”的长远利益眼光(长期主义),又无“社会主义”的福利动机(未来主义),这情形,给百姓发钱——就是类似UBI(Universal Basic Income,全民基本收入。山姆·奥特曼,甚至埃隆·马斯克都认为,随着AI的发展和生产普及,UBI是完全可能的),何止八成不可能——是百分之百不可能的!如果你要说加拿大、美国、欧洲、日本、甚至越南、朝鲜、古巴、中东各国、南美不知叫什么主义的政府都发钱(特别是疫情期间,就准UBI式发钱),他们有是“兵来将挡,水来土掩”式的理由,怼回来,完全不讲逻辑。

顺便说一句,碰巧来加拿大后遇到“疫情”,我在2020年3月“两会”期间,发文呼吁各国政府“发钱纾困”,也讲到“全民基本收入”(UBI)未来主义、长期主义的问题,结果,3月20日前后,加拿大政府就真的给因疫情不能上班的居民每月发2000加元(比我在中国退休的工资还多)。其实,给老百姓发钱的“准UBI”,把一句中国老话“留得青山在,不怕没柴烧”,放到国家政府层面看,就是现实的未来主义和长期主义。

如果说殖官主义的肉食者们(洋博士/土博士不少)鄙,就鄙在他们撰死了中国人的话语权、决策权、话术(谎言)权,象1970年代看的一部阿尔巴尼亚电影中,一句年轻人喊的反讽台词:“墨索里尼,永远有理!”

结果,填补“无效GDP”留下的财政负担,未来的国民收入被预支,导致百姓收入不涨,“社会财富的减法”。那些天量债务(无论是地方债还是铁总的债),最终都将通过未来的税收、收费或者隐性通胀来偿还,这无疑是对未来几代人财富的稀释和透支。现在大家感受到的收入增长乏力,正是对过去粗放型发展模式的“还债期”,而当下的亏空(包括不生娃),很难想象未来几代人要过怎样的日子才能熬过去,哪有福卡研究所王德培教授臆断的U字型“未来我们一定又是一个高峰”?!

小结一下

2026年的经济出路不在于规模的大小,而在于“转化率”。如果1块钱的GDP投入,能带来1.2、1.5块的社会财富增量,那是他们说的发展硬道理;如果10块钱的GDP投入,赚0.99块,甚至一无所获,且留下一堆维护费惊人的烂摊子(无效GDP),那是消耗(但愿他们不再瞎说成是:“艰难探索”,或干脆说是为了什么什么,牺牲一点经济算不了什么)。

朱随感触及了经济增长的本质:GDP只是账面上的“流水”,只有扣除成本,还清债务后剩下的“利润”,才是百姓兜里实实在在的钱。他说“少一些宏大叙事,多一些效益测算”,确实是缩小体感落差的金玉良言。

共生经济学对“无效GDP”的破解

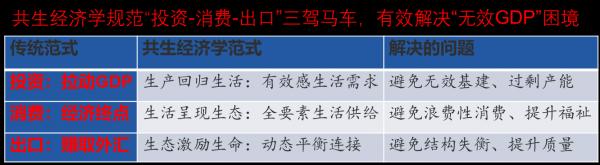

若用共生经济学(Symbionomics)“生产回归生活(有效感生活需求)-生活呈现生態(全要素生活供给)-生态激励生命(自组织连接动态平衡)”理论框架,重新规范和分析传统的“投资-消费-出口”三驾马车,可能提供一个新的分析视角。

共生经济学强调,政治、经济、文化活动是一个不可分割的生态整体,活动主体,称为仨自组织人或组织共生人或交互共生人,而不是单纯的“理性经济人”。仨自组织人的活动目标,是持续实现生命自组织动态平衡的交互主体共生(Intersubjective Symbiosism),而非单纯的经济数字增长。

传统的“投资、消费、出口”三驾马车侧重于流量(Flow)和速度,共生经济学框架则侧重于存量(Stock)、质量和连接效率。

1. 生产回归生活:规范“投资”

在传统经济学中,“投资”往往被视为拉动GDP增长的手段,容易导致您随笔中提到的“无效GDP”(如低效基建、过剩产能)。

共生经济学的规范:

目标转变: 投资的目的不再是单纯拉动GDP,而是回归到满足有效感的生活需求(Effective and Sensible Life Needs)。

投资标准: 衡量投资的不再是投入的规模,而是其能否转化为长期、可持续的“生活效用存量”。

具体体现:

有效投资的定义: 投资于能直接提升居民生活质量、降低生活成本、改善环境承载力的领域。例如:高质量的教育、医疗、公共交通、通信、清洁能源设施、旧城改造、高科技、新康乐等。

无效投资的剔除: 避免那些仅为短期数字好看而进行的重复建设或形象工程或干脆是“鬼城”投资,因为这些投资消耗了生态系统的资源,却没有产生有效的生活回报。

从“钢筋水泥”转向“人力资本”: 加大对人力资本和创新研发的投入,因为这是最能满足未来生活需求的有效生产要素。

2. 生活呈现生态:规范“消费”

传统经济学将“消费”视为经济增长的终点和引擎。但在共生框架下,消费是“生活呈现生态”的关键环节。

共生经济学的规范:

目标转变: 消费不再是简单的商品购买和资源消耗,而是构建一个全要素生活供给的生态系统,满足人的全面发展需求。

消费标准: 衡量消费质量的标准是个体福祉的提升和生态系统的健康程度,而非炫耀性消费或浪费。

具体体现:

生态化消费结构: 鼓励绿色消费、可持续消费、共享经济(如共享汽车、工具图书馆)。这些消费模式减少了资源浪费,提升了要素(全要素)利用效率。

体验与服务消费: 引导消费从物质产品转向服务、文化、健康、休闲、探索等领域。这些领域的供给更具“生态性”,能提供更丰富、更持久的生活价值。

数据作为要素: 将数据、知识、信息等新型生产要素纳入生活供给,满足个性化、趣味化、智能化的生活需求。

3. 生态激励生命:规范“出口”(以及整体动态平衡)

传统经济学中的“出口”关注国际贸易顺差和外汇积累。共生经济学则将此视为“生态激励生命”的外部连接与动态平衡机制。

共生经济学的规范:

目标转变: 出口的目标不是单纯赚取外汇,而是实现全球生态系统中的自组织连接和Live and let live的动态平衡。

出口标准: 衡量出口的标准是产品和服务的国际竞争力、技术附加值,以及是否符合全球可持续发展的规范。

具体体现:

高质量、高技术出口: 出口高附加值、低污染的产品(如新能源汽车、高科技设备、数字服务),参与全球价值链的高端环节。这不仅能获得更好的贸易回报,也能提升国内产业生态的生命力。

避免“环境倾销”: 不再以牺牲国内环境和降低人权(无效GDP的另一种体现)为代价进行低端制造产能过剩出口倾销。

双向流动与平衡: 强调进出口的动态平衡,通过进口优质资源、技术和服务来反哺国内生态(激励生命),形成良性循环,而不是一味追求巨额顺差导致贸易摩擦或资源耗竭。

总结:从经济增长范式到资源交互范式

通过共生经济学的框架来规范“投资-消费-出口”三驾马车,可以有效解决“无效GDP”困境:

这个新的分析框架,突出了经济系统的内在健康和可持续性,将经济活动与人类福祉和生态环境紧密结合,从而实现“真正的有效GDP投资”和“百姓有感落差逐步缩小”。

这就自然过度到共生经济学(Symbionomics)的国民账户(生产-交换-生活)核算体系——价值参量的改变,将由注重加法思维的资本增值/减值的GDP,改为乘法思维的资源能效/能耗的GDE,而且,统计数值范围,也由企业和政府两张资产(资源)负债表,扩展为自然、社会、家庭、社区、企业、政府六大资源(资产)负债表。

从传统GDP核算体系向GDE核算体系演进

从传统的GDP核算体系向共生经济学(Symbionomics)核算体系演进的关键路径——从“增量”思维转向“效率”思维,从“狭义主体”扩展到“广义生态”交互主体共生(Intersubjective Symbiosism)。

这不仅是核算方式的改变,更是一种深层次的经济哲学范式转移,旨在解决GDP体系下“无效生产”与“社会福祉”之间的巨大鸿沟。

共生经济学的国民账户体系:GDE(生態发展总值)

从GDP(国内生产总值)转向GDE(暂且称之为生態发展总值,Gross Development of Ecology或Gross Domestic Efficiency,注意:中文生態的態字构词,是“能”与“心”交互共生)的核心转变在于价值参量的改变。

1. 价值参量的转变:从“加法”到“乘法”(资本增值 vs 资源能效)

传统的GDP核算是“加法思维”:只要有交易和投入,就累加产值,不管其效率如何、是否浪费资源。无效基建和污染治理、“建路/挖路/再建”之所以都能计入GDP,就是因为这种加法属性。

共生经济学的GDE则采用“乘法思维”,关注资源能效(Efficiency)/能耗(Consumption):

GDE的核心关注点是效率和可持续性:它衡量的是单位资源投入所产生的综合社会效益和生态价值。

乘法效应意味着筛选: 一个高效利用资源、产生正外部性(如碳中和、生物多样性保护)的活动,其价值会被放大(乘数大于1或小于1甚至0以下为负数);而一个消耗资源巨大、产生负外部性(如污染、浪费)的活动,其价值会显现为“生態(自然、社会、家庭、社区、企业、政府)背负”,而被抑制甚至归零(乘数小于1)。

例子: 种100棵树(空气转换、风景、诗意)创造的GDE,可能远高于建一个无人居住的商场创造的GDP。因为前者能效高,后者能耗(资源浪费)高。

2. 核算范围的扩展:从两张表到六大表(企业/政府 vs 六大主体)

传统的国民经济核算主要围绕企业和政府展开,只关注狭义的货币化资产。

共生经济学统计数值扩展自然-社会-家庭-社区-企业-政府六大资源(资产)负债表。

3. 共生核算体系的内在逻辑:生产-交换-生活

这个新的核算体系完美地契合了“生产-交换-生活”的共生框架:

生产(回归生活需求): 关注企业和政府的资产表,衡量其是否创造了真正满足生活需求的有效产品和服务。

交换(全要素供给): 关注市场和社会资本的流动,确保交换过程是公平、高效、全要素的,而非仅仅货币化交易。

生活(激励生命): 最终落脚于家庭、社区、自然的资产表改善,衡量这些活动是否真正提升了生命形態的活力和动态平衡。

总之,GDE核算体系是对当前经济学范式的重大挑战和创新。通过引入“乘法思维”和扩展“六大资产负债表”,共生经济学试图建立一个更全面、更真实反映社会财富创造与分配的参量体系——21世纪人类政治经济文化组织行为价值参量标准。

因为共生经济学恋愛的是交互共生人,即(政治经济文化三位一体)“仨自组织人”,而不只是主流经济学的“理性经济人”,也不仅是奥派经济学笼统的“自由行动人”。

当然,GDE价值参量,不再简单地用数字堆砌繁荣假象,而是追问“这种增长的质量和效率如何?”和“谁真正从这种增长中受益(包括自然界)?”所以,它也是解决“GDP增长率锦标赛”生態背负,解决“无效GDP”与“百姓落差”悖论的关键所在。

先说到这里。

2025年12月28日凌晨于Vancouver

Resource Efficiency “Conversion Rate”

—The Key to Resolving the Disconnect Between “Macro Data” and “Micro Experience”

Archer Hong Qian

Starting from Zhu Yongmin’s “Reading Reflections”

Zhu Yongmin, an expert in China’s real estate and land-finance sector, recently shared a “reading reflection” that precisely captures the core contradiction in China’s current economy—the serious disconnect between “macro statistical performance” and “people’s lived experience.” His observation is highly insightful.

According to official reports, China’s GDP growth in 2025 exceeded 5% (leaving aside for now whether there was manipulation, such as economist Gao Shanwen’s claim that the 2023 and 2024 GDP figures were overstated by two percentage points). Yet ordinary people’s incomes have barely improved. Essentially, this reflects a disconnect between “wealth creation” and “numerical growth”—the existence of “ineffective GDP.” We can deepen Zhu’s observation using economic logic.

In economic terms, GDP is often divided into “Effective GDP” and “Ineffective (or Wasted) GDP,” mainly to assess the quality and sustainability of economic growth.

Effective GDP refers to economic activities that genuinely enhance productivity, increase national wealth, and improve living standards.

Ineffective GDP refers to activities that contribute statistically to GDP numbers but do not actually increase net social wealth—in many cases, they even cause resource wastage or negative consequences.

1. Where Did the Money Go? — From an “Accounting Identity” Perspective

Using the expenditure approach, the GDP formula is:

GDP = Consumption + Investment + Government Spending + Net Exports

Zhu observed that growth in 2025 is still largely driven by “investment” and “government spending” (such as western infrastructure projects, high-speed rail in prefectural cities, and urban mega-bridges).

But here’s the real issue:

For investment to translate into income, it must generate cash-flow returns. If the investment belongs to “ineffective GDP” (for example, deserted high-speed rail stations lost in weeds), then after modest wages are paid out during construction, what remains is dead debt that cannot later be repaid through operational profits, dividends, or wage growth. The money essentially becomes steel and concrete that cannot be monetized.

2. Ineffective GDP is Social Wealth Subtraction

Zhu mentions the Guizhou bridges and the China Railway’s 4-trillion-yuan debt as typical examples of “cross-temporal misallocation.”

Short term:

During construction, workers are hired, steel is purchased, GDP numbers look glorious, and leaders gain image projects.

Long term:

Maintenance costs exceed operational returns. Governments and enterprises must use future fiscal revenue (taxes and fees) to repay past debts. That means future national income is being pre-spent. This explains why people feel their incomes are not rising—because much of the newly created wealth is used to repay old bills (aside from rent-seeking leakage).

3. Corporate “Involution” and Ineffective Cycles

Economist Liu Yuanchun has pointed out “overproduction” and “involution,” which are actually forms of micro-level ineffective GDP:

Enterprises overproduce to maintain cash flow, even at extremely low or negative profit margins. Output (GDP) rises, but companies don’t earn money, so workers’ wages don’t rise either.

This kind of “profitless growth” essentially consumes capital stock instead of creating incremental social wealth.

4. “Benefit Evaluation” is the Only Cure

Zhu calls for scientifically evaluating economic benefits. This is the essence of transitioning from “high-speed growth” to “high-quality development.”

Effective GDP: reduces overall social costs (for example, subways that truly shorten commuting time, or 5G infrastructure that actually improves industrial productivity).

Ineffective GDP: increases social costs (for instance, ghost-town suburbs built only for data performance, underutilized highways, railways, and airports).

5. “Handing Out Cash to Citizens” Does Not Fit China’s Political Logic

Economists like Liu Yuanchun and Xiang Songzuo have repeatedly called for issuing direct stimulus payments to households. Whether or not such short-term measures could work economically, politically speaking it is highly unlikely to happen.

As Zhu notes, today’s decision-makers—including many highly educated elites—lack both the long-term capitalist perspective and the social-welfare motivation associated with socialism. So the idea of giving money directly to citizens is extremely improbable. And even if Western countries do it, their response would only be: “We’ll handle things our way”—logic entirely absent.

What is truly lamentable about China’s bureaucratic-elitist rulers is not just policy, but that they monopolize discourse power, decision-making authority, and the right to construct narratives—much like the ironic line from a 1970s Albanian film:

“Mussolini is always right!”

Summary So Far

Repaying the fiscal burden left by ineffective GDP means future national income is being diluted and consumed. Massive debts—whether local-government bonds or the Railway Group’s liabilities—will eventually be repaid through future taxes, fees, or hidden inflation. This reduces the wealth of future generations, explaining why people today feel income stagnation.

Therefore, the key to the 2026 economy is not scale, but conversion efficiency.

If 1 yuan of GDP investment creates 1.2 or 1.5 yuan of real wealth, that is meaningful development.

But if 10 yuan of investment only produces 0.99 yuan of benefit, or even nothing, while leaving behind massive long-term costs—that is not growth but consumption and burden.

GDP is just “cash flow.” Only after deducting costs and repaying debts do we see the real profits in ordinary people’s pockets.

Symbionomics’ Solution to Ineffective GDP

Using Symbionomics (共生经济学)—the framework of:

Production returns to life → Life presents ecology → Ecology stimulates life

we can regulate the traditional “investment–consumption–export” engine.

Symbionomics emphasizes that political, economic, and cultural activities form an inseparable ecological whole, driven not by abstract “rational economic man,” but by “threefold self-organizing human actors”—intersubjective symbiotic agents. Their real goal is dynamic balance of life through intersubjective symbiosis, not simply statistical growth.

Traditional macroeconomic frameworks emphasize flow and speed, while Symbionomics emphasizes stock, quality, and connection efficiency.

1. Production Returns to Life — Re-defining “Investment”

Investment should no longer simply stimulate GDP. Its purpose must return to meeting real life needs, generating long-term, sustainable living utility stock.

Effective investments include:

education, healthcare, public transit, telecommunications, clean energy, urban renewal, advanced technology, and meaningful recreation.

Ineffective investments include:

repetitive vanity projects, ghost cities, and infrastructure without utilization—consuming ecological and financial resources without real life returns.

This represents a shift from “steel and concrete investments” to “human capital and innovation investments.”

2. Life Presents Ecology — Re-defining “Consumption”

Consumption is not merely about spending; it is about building a comprehensive life-support ecosystem.

We measure consumption quality not by extravagance, but by well-being and ecological health.

Encouraged directions include:

? green & sustainable consumption

? sharing economy

? service, culture, health, leisure, exploration

? data, knowledge, and intelligence as essential life inputs

3. Ecology Stimulates Life — Re-defining “Exports”

Exports are not just about foreign exchange accumulation. They should enhance global ecological connection and balanced intersubjective coexistence.

This means:

? prioritizing high-value, high-technology exports

? eliminating environmental dumping

? avoiding growth based on abused labor or degraded rights

? maintaining balanced two-way flows to reinforce domestic vitality

From Growth Paradigm to Resource Interaction Paradigm

Using Symbionomics to regulate “investment–consumption–export” helps solve ineffective GDP by centering well-being, sustainability, connection efficiency, and systemic health. It narrows the gap between statistical prosperity and lived prosperity.

From GDP to GDE — A Paradigm Shift

Transitioning from GDP to GDE (Gross Domestic Efficiency / Gross Development of Ecology) represents a philosophical and structural transformation:

? from additive thinking to multiplicative efficiency thinking

? from two-account systems (government + corporations) to six major ecological balance sheets:

Nature ? Society ? Family ? Community ? Enterprise ? Government

GDE Focuses On:

? efficiency and sustainability

? positive externalities

? suppressing resource-waste activities

? enhancing life vitality and equilibrium

Under this framework, planting 100 trees may generate more genuine economic-ecological value than constructing a deserted luxury mall.

The Core Question Becomes:

“What is the quality and efficiency of growth?”

“Who truly benefits from it—including nature itself?”

Only then can humanity truly escape:

? GDP growth tournaments

? ineffective GDP

? widening gaps between statistics and lived experience

Written in Vancouver, 28 December 2025 (early morning)