制度性自残,还是制度性自救?——关税权之争涉及程序正义与政府效率相关性

Institutional Self-Harm or Institutional Self-Rescue?

制度性自残,还是制度性自救?

——The Tariff Authority Dispute Involves the Correlation Between Procedural Justice and Government Efficiency

——关税权之争涉及程序正义与政府效率相关性

钱 宏 Archer Hong Qian

(Intersubjective Symbiosism Founation)

摘要

关税权本是政府首脑的行政权,而非单纯立法权。美国自建国以来,关税事务一直归属总统与财政部管理,从未设立独立“海关总署”。假设最高法院裁定对美国国际贸易法院和联邦巡回法院判决川普总统关税权“无效”,这已超出“三权分立”的制度设置争论,直指美国能否在国际贸易中快速捍卫国家利益。若剥夺总统关税裁量,就是制度性自残;若在宪制框架下保留适度权能,则是制度性自救。

关键词

关税权;三权分立;国家利益;制度经济学;美国海关历史;制度性自残自救;化解“国际不对等+行政反应迟缓”的两难;“关税权”的逻辑链条;“制度性不对称”的国际解法;《紧急互惠关税权法》(草案)

目录

本文背景

一、海关的历史常识:从“行关文”到“行关税”

二、美国特殊情况及海关历史:三权分立与关税权之争

三、司法裁决与制度性风险

四、专门化解“国际不对等+行政反应迟缓”的两难

五、“制度性不对称”的国际解法(外部配套)

六、总结:“关税权”的逻辑链条(从行政合法性到政府

附录:《紧急互惠关税权法》(Emergency Reciprocity Authority Act, ERAA)草案提纲(便于政策沟通运行)

本文背景

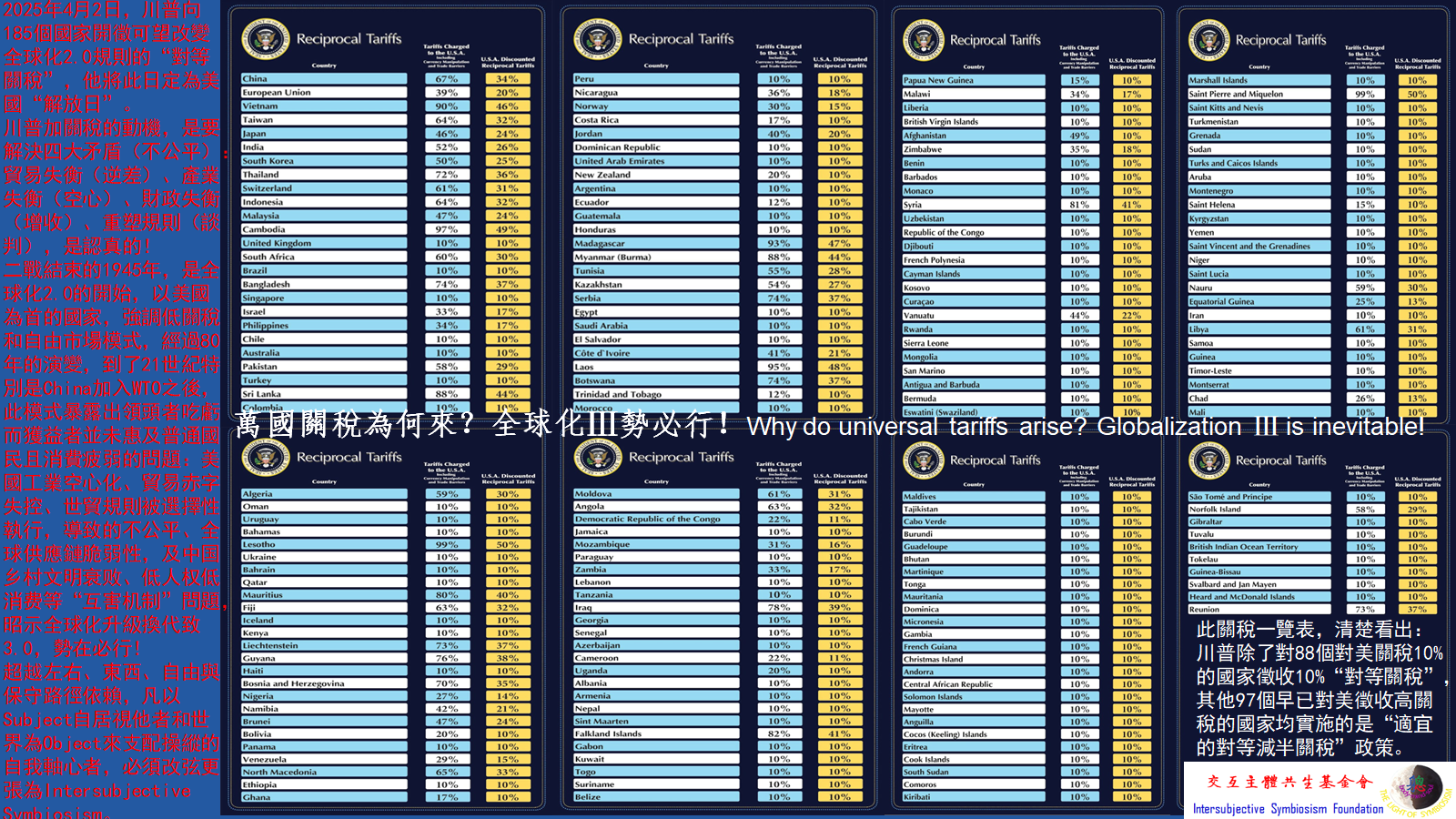

川普总统以“万国互惠关税”的方式,解决“特利芬-罗德里斯三元难题”条件下经济全球化(2.0)出现的国际贸易中对美贸易出现的“不公平”“非对等”问题,十分必要,不仅促使全球贸易规则重组(全球化3.0),而且,在相当长一段时间内可以增加美国政府的收益,四个多月来,这项政策已经取得“公平”与“减赤”双重针对性的显著成效。美国贸易法院(U.S. Court of International Trade)和美国联邦巡回法院(U.S. Court of Appeals for the Federal Circuit),受理国内某些企业起诉,判川普对等关税政策不合美国国内法“程序正义”,称关税权不属于总统,有待最高法院终审判决。我相信美国这两个法院的法官,不会傻逼到不管不顾美国人民和国家整体利益,但这里就有了一对小小矛盾:“国际贸易公平与国内程序正义”如何调节?

一、海关的历史常识:从“行关文”到“行关税”

早期“关文”——行政许可

在古代,海关最早的功能是“通行许可”。“关”就是关卡、边防口岸,主要任务是 检查和放行货物、人群,收取一定的“通关文牒”费用。

这一制度在中国、西方都有。中国汉唐就有“过所”“关牒”,欧洲中世纪各诸侯国也设关卡收过境费。

性质:行政行为,由君主或地方长官命令设立,并不需要议会立法批准。

近代“关税”——财政与贸易调节工具

进入近代以后,尤其是16–18世纪,随着国际贸易兴起,关卡逐渐演化为 国家财政和产业政策的重要来源。

中国明清时,“海关税收”成为中央财政的重要组成部分;欧洲各国通过关税保护国内产业。

无论中西,关税的征收权仍然主要体现为 政府的行政权力,因为其直接由国王/皇帝/内阁行使,属于财政收支的组成部分。

议会或代议机构顶多起到 批准预算或监督财政 的作用,而不是直接操作“行关税”。

国际比较与制度本质

中国与大陆传统:1)、无论古代还是今天,中国的海关完全是行政机关,由中央政府设立、管理和调整关税政策;2)、 关税政策属于财政部+海关总署的一体化操作,立法机关(全国人大)一般不直接介入。

欧洲传统:1)、英国、法国等国,议会对关税有一定立法监督,但主要体现在税收法案的批准;2)、实际操作权仍在行政部门(财政部或海关局)。

美国的“混合模式”:1)、宪法把关税设为国会的权力,反映了当时“无代表,不纳税”的独立革命精神;2)、但现代化以来,国会通过法律授权,已把绝大部分操作权交给总统和行政机关;3)、名义上属立法权,实质上属行政权。

从世界历史看,从“行关文”到“行关税”,都延续了一个逻辑:关税属于国家行政权(尤其是财政行政权),不是立法机关的细分领域。

二、美国特殊情况及海关历史:三权分立与关税权之争

关税政策在历史实践上本质是行政权延伸。

宪法上的规定

美国宪法第一条第八款明确规定:国会有权征收关税(Duties, Imposts, Excises)。这是因为当时美国建国初期,关税是联邦政府最主要的财政来源,所以制宪者把它放在国会(立法机关)手里,以确保“税收必须经过人民代表同意”。

但美国没有独立的“海关总署”:宪法同时允许国会把部分权力授权给总统。

总统的“行政裁量”

美国有海关与边境保护局(CBP),隶属国土安全部,是一个典型的行政机关,负责执行关税和进出口管制,海关事务始终处于行政体系,受总统政府直接管控。

总统在关税政策上的权力,主要来源于国会授予的法律授权;

《贸易扩展法》(Trade Expansion Act, 1962)第232条,允许总统以“国家安全”为由调整关税;

《贸易法》(Trade Act, 1974)第301条,允许总统因“不公平贸易行为”加征关税;

关税减免、豁免和具体实施细节,通常由行政部门直接执行。

因此,美国的实际操作是:国会立法设定框架,总统和行政机关根据实际情况执行与调整。

立法与实践案例

1789年:第一届国会通过《关税法》,设立财政部,海关事务归其直接管辖;

1789—1927年:各大港口由总统任命关长,属行政任命;

1927年:成立 美国关税局(U.S. Customs Service),隶属财政部;

2003年:重组为 美国海关与边境保护局(CBP),并入国土安全部。

2018年川普总统援引《贸易扩展法》第232条,对钢铁和铝产品加征关税,这是典型的行政权直接操作关税。

拜登政府在2022年维持甚至扩大对华关税,也没有走国会立法程序,而是延续总统的行政裁量。

可见,美国虽然在宪法上强调国会对关税的立法权,但在现代国际贸易关系中,总统已实质掌握关税政策主动权。

总之,海关与关税,不只是抽象立法,而是直接服务于国家财政与国际交往的工具与国家行政长官的权能。

三、司法裁决与制度性风险

美国最高法院对总统关税权的裁决,将聚焦于“形式与实质”:

形式:关税是国会立法权还是总统行政权?

实质:总统在应对不公平贸易时是否拥有快速反应能力?

若裁决收窄总统权力,将使美国在国际博弈中处于制度性不对等地位。

在国际贸易中,若各国行政长官拥有不同层级的关税权能,制度不对称就意味着国家利益自我削弱:

制度性自残:总统关税权受限,导致美国在国际贸易政策实施上反应迟缓;

制度性自救:在三权分立框架下,赋予总统合理的裁量与快速反应空间,以捍卫国家整体利益。

如果美国总统的关税权被过度限制,出现制度性自残,那么受益者是谁?

国际竞争对手:

例如依赖补贴、倾销、货币操纵等方式获利的国家。

他们最希望美国在制度上“拖慢动作”,无法及时应对。

国内既得利益集团:

部分依赖海外廉价生产的企业及背后资本权贵,乐见总统失去关税反制权,以便继续保持短期利润。

而真正受伤的,则是美国的整体国家利益:制造业空心化、就业机会减少、国家战略空间缩小、国际贸易规则的破坏。

因此,关税权的核心,不仅仅是“权力如何分立”的制度设计问题,更是国家如何在国际秩序中有效自我防卫的根本问题,而且是美国作为文明国家对于国际贸易规则和“全球化重组”的示范性意义——如何再次伟大的问题。

四、专门化解“国际不对等+行政反应迟缓”的两难

制度性自残,还是制度性自救?这是美国今天必须回答的抉择。

让我们回到“无代表,不纳税”原则(No Taxation without Representation)→三权分立制度(Separation of Powers)→关税权的归属(Tariff Power)三大关联项,继续讨论在可操作的制度与流程上,如何解决“关税权”归属在实际运用中存在的问题?

1、目标与约束(从原则到边界)

代议正当性(No Taxation without Representation):关税属于税负的一种,源头权在国会(美国宪法第一条第八款)。任何让总统迅速行动的安排,都必须建立在国会事先授权或事后可控的基础上。constitution.congress.gov

分权制衡(Separation of Powers):允许行政机关“快”,但必须有明晰授权、事实认定、可诉可审的围栏,避免越权或程序瑕疵被法院推翻(近年在232、301、乃至以IEEPA为依据的诉讼都给出过教训与启示)。Justia Lawcafc.uscourts.gov+1Justia法律

国际竞争有效性:对手可以“秒级”响应时,美国若层层缓慢就构成“制度性自残”。因此需要快触发 + 强监督的组合,而不是“要么极慢、要么越权”的二选一。近来的IEEPA判例趋势也提示:别把IEEPA当作一般性关税法用,应回到或更新专门授权路径。AP NewsReutersThe Washington Post

2、一套可落地的制度组合(Fast-Fair Tariff Architecture, “FFTA”)

1)、预授权:建立“紧急互惠关税权”(Emergency Reciprocity Authority, ERA)专章立法

由国会专门立法授予总统一项限时、限域、可审的快速关税权,用来应对对等性失衡与突发型不公平:

A、触发要件(必须写入法条):明确列举的客观指标(如对方加权有效关税/非关税壁垒指数、受补贴倾销判定、强制技术转移、国家安全相关供给链风险等),一旦超过阈值即可触发;指标与证据由商务部/ITC/USTR出具即时性“初步认定报告”,附最低限度公开数据。

B、关税幅度与“互惠公式”:法律中预设“互惠调节公式”(例如把美国对该类产品的适用税率锚定为对方对等产品的实际障碍强度,并设定法定上限与阶梯“snapback”)。

C、时效与日落:先行生效90–180天(总统可立即发布),到期自动失效,除非国会以快速程序表决通过延长/调整;每次延长须有更新事实记录与影响评估。

D、国会快速监督:强制48小时内通报“四大贸易/财政委员会”;15–30天内举行听证;设定快速“批准/否决”程序(类比《国会审查法》与贸易快审机制),保障“无代表,不纳税”的民主控制。

注:此路与现有232(国家安全)、201(保障措施)、301(应对不公平做法)并行不悖,但不再滥用IEEPA(国际紧急经济权力法)。Justia LawAkin - Akin, an Elite Global Law Firmbutzel.com

2)、程序正义与可诉性:把“快”做在前,把“稳”做在后

A、紧急情形的最小程序:公布要点理由书与核心证据表(可作适度保密处理),同步开启7天简式意见窗口;30天内发布正式答复与修订,把行政记录补充完整,以经受APA(行政程序法)与CIT/CAFC审查(301案的来回“发回重审—维持”就凸显了记录与论证的重要性)。Justia法律cit.uscourts.gov

B、专属且提速的司法通道:指定国际贸易法院(CIT)为一审专属管辖,60–90天加速审理;上诉到联邦巡回同样走加速轨;立法明确审查标准(如“是否逾越授权”“是否缺乏理性解释”),减少法庭对“程序/权限”反复拉扯造成的政策停摆。

C、“持续行动”条款:借鉴Transpacific对232“持续行动”理解,在新法中明确允许在同一事实认定周期内按预设条件做后续微调,避免因“时限/形式”问题被推翻。cafc.uscourts.govSteptoestudentbriefs.law.gwu.edu

3)、代表性与透明度:把“无代表,不纳税”嵌进执行层面

A、必备的国会报告包:影响评估(消费者价格、就业、供应链安全与盟友影响)、互惠指数变化、替代政策对比;

B、州际均衡说明(宪法“统一税则”地理均一性的现代理解),与弱势行业/小企业的配套减负与转岗支持。constitution.congress.gov

4)、与既有法律的分工协同(少走IEEPA,多用专法)

A、232(国家安全):在能源、关键矿产、国防工业链等安全敏感品类优先用232(其合宪授权基础较稳固)。Justia LawAkin - Akin, an Elite Global Law Firmbutzel.com

B、201(保障)/ 701-731(反补贴/反倾销):用于行业受损与不公平定价场景;

C、301(系统性不公平做法):保留,但必须严格APA记录与意见答复(CIT在301清单案的审查路径已给出合格范式)。Justia法律cit.uscourts.gov

D、IEEPA:仅限制裁/禁运等传统用途,不宜作为普遍性关税法源(近期多案判决趋势不利)。AP NewsReutersThe Washington Post

五、“制度性不对称”的国际解法(外部配套)

1.“互惠准入协定”(RAA)与“自动回摆”条款:与主要伙伴(欧盟、日本、英、加、越等)签署多边/复边互惠协议,采用同一“互惠公式”与自动snapback,把临时关税变成规则化的合约回应,减少WTO争端不确定性。

2.把关税与补贴纪律联动:将产业补贴、国企中性、数据/技术强迫转移纳入同一互惠框架,形成“障碍—关税—补救”的闭环。

3.WTO路径的合规设计:优先走AD/CVD/保障措施与条约性豁免,慎用国家安全例外,降低“报复—反报复”循环。

4.场景化示例(工作流):1)、USTR/商务部每季更新“互惠失衡清单”→发现某国在关键品类的有效障碍指数跨阈值;2)、总统依ERA发布临时互惠关税(即时生效),同时披露要点理由书并开启7日意见收集;3、15–30天国会听证 + 快速表决通道启动;4)、行政机关发布正式理由与微调,完善记录;5)若被诉,走CIT加速审理;90–180天窗口期满后,除非国会通过继续决议,否则自动日落。

总之,这套解法“快而不失正当”:

速度:总统拥有即时触发的工具,应对对手“秒级”动作;

合法性:源自国会预授权 + 快速监督 + 强制理由公开 + 可诉可审;

可持续:与232/301/AD-CVD并行不冲突,把IEEPA争议边缘化,符合近年的司法走向;AP NewsReutersJustia LawJustia法律

可复制到多国博弈:通过互惠公式与复边协议,把一次次“个案谈判”变成“规则化自动重组”。

六、总结:“关税权”的逻辑链条(从行政合法性到政府效率)

关税权的运行逻辑Fast-Fair Tariff Architecture (FFTA)图解:

┌─────────────────────┐

│ LEGITIMACY 合法性 │ ← “无代表,不纳税”

│ Taxation = Representation

│ 国会为源头(宪法 I-8)

└─────────┬──────────┘

│ 预授权 (Delegation)

┌─────────▼──────────┐

│ DELEGATION 授权 │ ← 国会立法预设紧急互惠关税权(ERA)

│ - 明确触发条件

│ - 互惠公式 & 上限

│ - 限时/日落条款

└─────────┬──────────┘

│ 程序围栏 (Guardrails)

┌─────────▼──────────┐

│ GUARDRAILS 围栏 │ ← 三权分立中的司法与监督

│ - 必须公示理由书

│ - 7日意见 & 30日修订

│ - 国会快速表决通道

│ - CIT/CAFC加速审理

└─────────┬──────────┘

│ 行动力 (Speed)

┌─────────▼──────────┐

│ SPEED 速度 │ ← 行政即时触发

│ - 总统180-360日快速关税

│ - 即时互惠回摆(snapback)

│ - 自动到期 unless国会延长

合法性 → “无代表,不纳税”原则;授权 → 国会事先立法设定ERA;围栏 → 程序正义、司法审查、国会监督;速度 → 总统可立即实施,保障国家利益

附录:《紧急互惠关税权法》(Emergency Reciprocity Authority Act, ERAA)草案提纲(便于政策沟通运行)

第一章 总则

第1条 【目的】保障美国在国际贸易中的公平对等,兼顾民主合法性与行政效率性。

第2条 【定义】“紧急互惠关税”指总统依本法对他国不公平贸易障碍采取的临时性、对等性关税措施。

第二章 国会预授权

第3条 【授权范围】总统可在以下情形触发紧急互惠关税:

他国实施实质性关税或非关税壁垒;

存在补贴倾销、强制技术转移或关键产业安全风险。

第4条 【互惠公式】关税幅度按“对方障碍强度”设定,并不得超过本法规定上限。

第5条 【时效条款】措施自发布之日起生效180日,延长不得超过360日;到期自动失效,除非国会表决延长。

第三章 程序与监督

第6条 【理由公开】总统发布关税时,须同时公布要点理由书与核心证据表。

第7条 【意见征集】自发布之日起7日内开放意见征集,30日内发布修订。

第8条 【国会监督】48小时内通知四大贸易/财政委员会;15–30日内必须举行听证并快速表决。

第四章 司法审查

第9条 【司法管辖】国际贸易法院(CIT)为专属一审,60日内裁判;联邦巡回法院30日内加速审理。

第10条 【审查标准】法院仅审查是否超越授权、是否缺乏合理解释。

第五章 附则

第11条 【协调条款】本法与232、301、201等现行法律并行适用;不得以IEEPA替代。

第12条 【日落条款】本法五年后须由国会复审是否继续有效,若国会届时未复审,则顺延五年。

孞烎2025年9月1日草于Richmond心约开关居

Institutional Self-Harm or Institutional Self-Rescue?

——The Tariff Authority Dispute Involves the Correlation Between Procedural Justice and Government Efficiency

By Archer Hong Qian

(Intersubjective Symbiosism Foundation)

#### Abstract

Tariff authority is inherently the executive power of the head of government, rather than purely legislative power. Since the founding of the United States, tariff affairs have always been under the management of the President and the Treasury Department, without establishing an independent "Customs Administration." Assuming the Supreme Court rules on the judgments of the U.S. Court of International Trade and the U.S. Court of Appeals for the Federal Circuit that President Trump's tariff authority is "invalid," this goes beyond the institutional debate over "separation of powers" and directly questions whether the U.S. can swiftly defend national interests in international trade. Stripping the President of tariff discretion would be institutional self-harm; retaining appropriate authority within the constitutional framework would be institutional self-rescue.

#### Keywords

Tariff authority; separation of powers; national interests; institutional economics; history of U.S. customs; institutional self-harm and self-rescue; resolving the dilemma of "international asymmetry + sluggish administrative response"; the logical chain of "tariff authority"; international solutions to "institutional asymmetry"; Draft of the "Emergency Reciprocity Tariff Authority Act"

#### Table of Contents

Background of This Article

Historical Common Knowledge of Customs: From "Travel Customs Documents" to "Customs Tariffs"

Special Circumstances in the U.S. and History of Customs: Separation of Powers and the Tariff Authority Dispute

III. Judicial Rulings and Institutional Risks

Specifically Resolving the Dilemma of "International Asymmetry + Sluggish Administrative Response"

International Solutions to "Institutional Asymmetry" (External Support)

Summary: The Logical Chain of "Tariff Authority" (From Administrative Legitimacy to Government Efficiency)

Appendix: Outline of the Draft "Emergency Reciprocity Tariff Authority Act" (Emergency Reciprocity Authority Act, ERAA) (For Facilitating Policy Communication and Operation)

#### Background of This Article

President Trump is addressing the "unfair" and "non-reciprocal" issues in U.S. trade arising from economic globalization (2.0) under the conditions of the "Triffin-Rodrik trilemma" through the method of "universal reciprocal tariffs." This is an absolutely necessary measure, not only promoting the reorganization of global trade rules (Globalization 3.0), but also significantly increasing the U.S. government's revenue over a considerable period. Over the past four months, this policy has already achieved notable results targeting both "fairness" and "deficit reduction." The U.S. Court of International Trade and the U.S. Court of Appeals for the Federal Circuit have accepted lawsuits from certain domestic enterprises, ruling that Trump's reciprocal tariff policy violates U.S. domestic law on "procedural justice," claiming that tariff authority does not belong to the President, pending a final decision from the Supreme Court. I believe the judges of these two U.S. courts will not be foolish enough to disregard the overall interests of the American people and nation, but this presents a minor contradiction: How to balance "international trade fairness and domestic procedural justice"?

#### I. Historical Common Knowledge of Customs: From "Travel Customs Documents" to "Customs Tariffs"

Early "Customs Documents" — Administrative Permits

In ancient times, the earliest function of customs was "passage permits." "Customs" refers to checkpoints and border ports, with the main tasks of inspecting and releasing goods and people, collecting certain "customs clearance document" fees.

This system existed in both China and the West. China had "passes" and "customs certificates" during the Han and Tang dynasties, while European feudal states in the Middle Ages also set up checkpoints to collect transit fees.

Nature: Administrative actions, established by orders from monarchs or local officials, without needing parliamentary legislative approval.

Modern "Tariffs" — Tools for Fiscal and Trade Regulation

In the modern era, especially from the 16th to 18th centuries, with the rise of international trade, checkpoints gradually evolved into important sources of national revenue and industrial policy.

During China's Ming and Qing dynasties, "customs revenue" became a significant part of central finances; European countries used tariffs to protect domestic industries.

In both East and West, the authority to levy tariffs remained primarily an executive power of the government, as it was directly exercised by kings/emperors/cabinets and was part of fiscal revenues and expenditures.

Parliaments or representative bodies at most played a role in approving budgets or supervising finances, rather than directly operating "customs tariffs."

International Comparisons and Institutional Essence

China and Continental Tradition: 1) Whether in ancient times or today, China's customs is entirely an administrative agency, established, managed, and adjusted by the central government for tariff policies; 2) Tariff policies are integrated operations of the Ministry of Finance + General Administration of Customs, with the legislative body (National People's Congress) generally not directly intervening.

European Tradition: 1) In countries like Britain and France, parliaments have certain legislative oversight over tariffs, but mainly in approving tax bills; 2) Actual operational authority remains with administrative departments (Ministry of Finance or Customs Bureau).

U.S. "Hybrid Model": 1) The Constitution designates tariffs as congressional legislative power, reflecting the "no taxation without representation" spirit of the independence revolution at the time; 2) But since modernization, Congress has delegated most operational authority to the President and executive agencies through laws; 3) Nominally legislative power, but substantively executive power.

From world history, from "travel customs documents" to "customs tariffs," a logic has been continued: Tariffs belong to national executive power (especially fiscal executive power), not a subdivided field of legislative bodies.

#### II. Special Circumstances in the U.S. and History of Customs: Separation of Powers and the Tariff Authority Dispute

Tariff policies, in historical practice, are essentially extensions of executive power.

Constitutional Provisions

The U.S. Constitution, Article I, Section 8, explicitly states: Congress has the power to levy tariffs (Duties, Imposts, Excises). This is because in the early days of the U.S. founding, tariffs were the primary source of federal government revenue, so the framers placed it under Congress (the legislative branch) to ensure "taxation must be approved by representatives of the people."

However, the U.S. has no independent "Customs Administration": The Constitution also allows Congress to delegate some powers to the President.

Presidential "Executive Discretion"

The U.S. has the Customs and Border Protection (CBP), affiliated with the Department of Homeland Security, which is a typical executive agency responsible for enforcing tariffs and import/export controls. Customs affairs have always been within the executive system, under direct control of the presidential administration.

The President's authority in tariff policies mainly comes from legal delegations granted by Congress;

Section 232 of the Trade Expansion Act (1962) allows the President to adjust tariffs on grounds of "national security";

Section 301 of the Trade Act (1974) allows the President to impose tariffs due to "unfair trade practices";

Tariff reductions, exemptions, and specific implementation details are usually directly executed by the executive branch.

Therefore, the actual operation in the U.S. is: Congress legislates to set the framework, while the President and executive agencies execute and adjust based on actual situations.

Legislative and Practical Cases

1789: The First Congress passed the Tariff Act, establishing the Treasury Department, with customs affairs under its direct jurisdiction;

1789–1927: Customs collectors at major ports were appointed by the President, as executive appointments;

1927: Establishment of the U.S. Customs Service, affiliated with the Treasury Department;

2003: Reorganized into U.S. Customs and Border Protection (CBP), incorporated into the Department of Homeland Security.

2018: President Trump invoked Section 232 of the Trade Expansion Act to impose tariffs on steel and aluminum products, a typical direct executive operation of tariffs.

The Biden administration in 2022 maintained and even expanded tariffs on China, without going through congressional legislative procedures, but continuing presidential executive discretion.

It can be seen that although the U.S. emphasizes congressional legislative power over tariffs in the Constitution, in modern international trade relations, the President has substantially held the initiative in tariff policies.

In summary, customs and tariffs are not just abstract legislation but tools directly serving national finances and international relations, as well as the authority of national administrative leaders.

#### III. Judicial Rulings and Institutional Risks

The U.S. Supreme Court's ruling on presidential tariff authority will focus on "form and substance":

Form: Is tariff authority congressional legislative power or presidential executive power?

Substance: Does the President possess rapid response capabilities when addressing unfair trade?

If the ruling narrows presidential power, it will place the U.S. in an institutionally asymmetric position in international competition.

In international trade, if administrative leaders of various countries possess different levels of tariff authority, institutional asymmetry means weakening of national interests:

Institutional self-harm: Limiting presidential tariff authority leads to sluggish U.S. responses in international trade policy implementation;

Institutional self-rescue: Within the separation of powers framework, granting the President reasonable discretion and rapid response space to safeguard overall national interests.

If the President's tariff authority is excessively restricted, leading to institutional self-harm, then who benefits?

International competitors:

For example, countries benefiting from subsidies, dumping, currency manipulation, etc.

They most hope for the U.S. to be "slowed down" institutionally, unable to respond promptly.

Domestic vested interest groups:

Certain enterprises and the capital elites behind them that rely on cheap overseas production would welcome the President losing tariff counter-measures to maintain short-term profits.

The true losers are the overall national interests of the U.S.: hollowing out of manufacturing, reduced job opportunities, shrinking strategic space, and disruption of international trade rules.

Therefore, the core of tariff authority is not merely a question of "how power is divided" in institutional design, but a fundamental issue of how a nation effectively defends itself in the international order. Moreover, it is the demonstrative significance of the U.S. as a civilized nation for international trade rules and "globalization reorganization"—how to be great again.

#### IV. Specifically Resolving the Dilemma of "International Asymmetry + Sluggish Administrative Response"

Institutional self-harm or institutional self-rescue? This is the choice the U.S. must answer today.

Let us return to the "no taxation without representation" principle (No Taxation without Representation) → separation of powers system (Separation of Powers) → three major linkages of tariff authority attribution (Tariff Power), and continue discussing how to resolve the issues in the operational system and process of "tariff authority" attribution?

Goals and Constraints (From Principles to Boundaries)

Representational Legitimacy (No Taxation without Representation): Tariffs are a form of tax burden, with the source authority in Congress (U.S. Constitution Article I, Section 8). Any arrangement allowing the President to act swiftly must be based on prior congressional authorization or post-event controllability. constitution.congress.gov

Separation of Powers (Separation of Powers): Allowing the executive branch to be "fast," but must have clear authorizations, fact-finding, appealable and reviewable fences to avoid overreach or procedural flaws being overturned by courts (recent lessons from lawsuits based on 232, 301, and even IEEPA). Justia Law cafc.uscourts.gov +1 Justia Law

International Competitive Effectiveness: When opponents can respond at "second-level," if the U.S. is layered and slow, it constitutes "institutional self-harm." Therefore, a combination of fast triggers + strong supervision is needed, rather than the binary choice of "either extremely slow or overreaching." Recent IEEPA rulings also suggest: Don't use IEEPA as a general tariff law; should return to or update specific authorization paths. AP News Reuters The Washington Post

A Set of Implementable Institutional Combinations (Fast-Fair Tariff Architecture, "FFTA")

1) Pre-Authorization: Establish a specialized chapter legislation granting the President a time-limited, domain-limited, reviewable fast tariff authority to address reciprocity imbalances and sudden unfair practices:

Trigger Requirements (Must be Written into the Law): Clearly enumerated objective indicators (such as the other party's weighted effective tariff/non-tariff barrier index, subsidized dumping determination, forced technology transfer, national security-related supply chain risks, etc.), which can be triggered once exceeding the threshold; indicators and evidence are issued by the Department of Commerce/ITC/USTR with immediate "preliminary determination reports," attached with minimum public data.

Tariff Amplitude and "Reciprocity Formula": Pre-set "reciprocity adjustment formula" in the law (for example, anchoring the U.S. applicable tax rate for such products to the actual barrier intensity of the other party's equivalent products, and setting statutory upper limits and tiered "snapback").

Time Limit and Sunset: Take effect first for 90–180 days (President can issue immediately), automatically expire upon expiration unless Congress passes an extension/adjustment through fast procedures; each extension must have updated fact records and impact assessments.

Congressional Fast Oversight: Mandatory notification within 48 hours to the "four major trade/finance committees"; hold hearings within 15–30 days; set fast "approval/veto" procedures (similar to the Congressional Review Act and trade fast-track mechanisms), ensuring democratic control of "no taxation without representation."

Note: This path runs parallel to existing 232 (national security), 201 (safeguards), 301 (unfair practices), but no longer abuses IEEPA (International Emergency Economic Powers Act). Justia Law Akin - Akin, an Elite Global Law Firm butzel.com

2) Procedural Justice and Appealability: Put "fast" in front, put "stable" in back

Minimum Procedures for Emergency Situations: Publish key reasons documents and core evidence tables (can be appropriately classified), simultaneously open a 7-day simplified opinion window; release formal responses and revisions within 30 days, supplement administrative records completely to withstand APA (Administrative Procedure Act) and CIT/CAFC reviews (the back-and-forth "remand-uphold" in 301 cases highlights the importance of records and arguments). Justia Law cit.uscourts.gov

Dedicated and Accelerated Judicial Channels: Designate the Court of International Trade (CIT) as exclusive first-instance jurisdiction, with accelerated hearings in 60 days; appeals to the Federal Circuit also follow accelerated tracks; legislation clarifies review standards (e.g., "whether exceeding authorization," "whether lacking rational explanation"), reducing policy halts caused by courts repeatedly pulling on "procedure/authority."

"Ongoing Action" Clause: Drawing from Transpacific's understanding of 232 "ongoing actions," explicitly allow follow-up fine-tuning under preset conditions within the same fact determination cycle in the new law, avoiding invalidation due to "time limits/forms." cafc.uscourts.gov Steptoe studentbriefs.law.gwu.edu

3) Representativeness and Transparency: Embed "No Taxation Without Representation" into the Execution Level

Mandatory Congressional Report Packages: Impact assessments (consumer prices, employment, supply chain security and ally impacts), reciprocity index changes, alternative policy comparisons;

Interstate Equity Explanations (Modern understanding of the Constitution's "uniform tax rules" geographic uniformity), with supporting burden reductions and job transition support for disadvantaged industries/small businesses. constitution.congress.gov

4) Division of Labor and Coordination with Existing Laws (Less Use of IEEPA, More Use of Specialized Laws)

232 (National Security): Prioritize use in security-sensitive categories such as energy, critical minerals, defense industrial chains, etc. (Its constitutional authorization foundation is relatively stable). Justia Law Akin - Akin, an Elite Global Law Firm butzel.com

201 (Safeguards)/701-731 (Countervailing Duties/Anti-Dumping): Used for industry damage and unfair pricing scenarios;

301 (Systematic Unfair Practices): Retained, but must strictly follow APA records and opinion responses (CIT's review path in 301 list cases has provided a qualified paradigm). Justia Law cit.uscourts.gov

IEEPA: Limited to traditional uses such as sanctions/embargoes, not suitable as a general tariff source (Recent multiple rulings trend unfavorable). AP News Reuters The Washington Post

#### V. International Solutions to "Institutional Asymmetry" (External Support)

"Reciprocity Access Agreements" (RAA) and "Automatic Snapback" Clauses: Sign multilateral/plurilateral reciprocity agreements with major partners (EU, Japan, UK, Canada, Vietnam, etc.), adopting the same "reciprocity formula" and automatic snapback, turning temporary tariffs into rule-based contractual responses, reducing WTO dispute uncertainties.

Linking Tariffs with Subsidy Disciplines: Incorporate industrial subsidies, state-owned enterprise neutrality, data/technology forced transfers into the same reciprocity framework, forming a closed loop of "barriers—tariffs—remedies."

WTO Path Compliant Design: Prioritize AD/CVD/safeguard measures and treaty-based exemptions, use national security sparingly to reduce "retaliation—counter-retaliation" cycles.

Scenario Examples (Workflow): 1) USTR/Department of Commerce updates "reciprocity imbalance list" quarterly → discovers a country's effective barrier index crossing threshold in key categories; 2) President issues temporary reciprocity tariffs under ERA (immediate effectiveness), while disclosing key reasons and opening 7-day opinion collection; 3) 15–30 days congressional hearings + fast voting channels start; 4) Executive agency releases formal reasons and fine-tunings, perfecting records; 5) If sued, go through CIT accelerated hearings; after 90–180 day window, automatically sunset unless Congress passes continuation resolution.

In summary, this set of solutions is "fast without losing legitimacy":

Speed: President has immediate trigger tools to counter opponents' "second-level" actions;

Legitimacy: Derived from congressional pre-authorization + fast oversight + mandatory reason disclosure + appealable and reviewable;

Sustainability: Parallel to 232/301/AD-CVD without conflict, marginalizing IEEPA controversy;

Replicable to Multi-Country Games: Through reciprocity formulas and plurilateral agreements, turning repeated "case-by-case negotiations" into "rule-based automatic reorganization."

#### VI. Summary: The Logical Chain of "Tariff Authority" (From Administrative Legitimacy to Government Efficiency)

Diagram of the Operational Logic of Tariff Authority Fast-Fair Tariff Architecture (FFTA):

┌─────────────────────┐

│ LEGITIMACY 合法性 │ ← “No Taxation Without Representation”

│ Taxation = Representation

│ Congress as Source (Constitution I-8)

└─────────┬──────────┘

│ Delegation

┌─────────▼──────────┐

│ DELEGATION 授权 │ ← Congress Legislates Preset Emergency Reciprocity Tariff Authority (ERA)

│ - Clear Trigger Conditions

│ - Reciprocity Formula & Upper Limits

│ - Time Limits/Sunset Clauses

└─────────┬──────────┘

│ Guardrails (Guardrails)

┌─────────▼──────────┐

│ GUARDRAILS 围栏 │ ← Judicial and Oversight in Separation of Powers

│ - Must Publicize Reasons Documents

│ - 7-Day Opinions & 30-Day Revisions

│ - Congressional Fast Voting Channels

│ - CIT/CAFC Accelerated Hearings

└─────────┬──────────┘

│ Action (Speed)

┌─────────▼──────────┐

│ SPEED 速度 │ ← Executive Immediate Trigger

│ - President 180-360 Day Fast Tariffs

│ - Immediate Reciprocity Snapback

│ - Automatic Expiration Unless Congress Extends

Legitimacy → "No Taxation Without Representation" Principle; Delegation → Congress Pre-Legislates to Set ERA; Guardrails → Procedural Justice, Judicial Review, Congressional Oversight; Speed → President Can Implement Immediately, Safeguarding National Interests

#### Appendix: Outline of the Draft "Emergency Reciprocity Tariff Authority Act" (Emergency Reciprocity Authority Act, ERAA) (For Facilitating Policy Communication and Operation)

Chapter One: General Provisions

Article 1 [Purpose] To safeguard fairness and reciprocity in U.S. international trade, balancing democratic legitimacy and administrative efficiency.

Article 2 [Definitions] "Emergency reciprocity tariffs" refer to temporary, reciprocal tariff measures taken by the President under this Act against unfair trade barriers of other countries.

Chapter Two: Congressional Pre-Authorization

Article 3 [Authorization Scope] The President may trigger emergency reciprocity tariffs in the following circumstances:

Other countries implement substantial tariffs or non-tariff barriers;

Existence of subsidized dumping, forced technology transfers, or key industry security risks.

Article 4 [Reciprocity Formula] Tariff amplitudes are set according to the "other party's barrier intensity" and must not exceed the upper limits prescribed by this Act.

Article 5 [Time Limit Clauses] Measures take effect from the date of issuance for 180 days, extensions not exceeding 360 days; automatically expire upon expiration unless Congress votes to extend.

Chapter Three: Procedures and Oversight

Article 6 [Reasons Disclosure] When the President issues tariffs, must simultaneously publish key reasons documents and core evidence tables.

Article 7 [Opinion Collection] Open opinion collection for 7 days from the date of issuance, release revisions within 30 days.

Article 8 [Congressional Oversight] Notify the four major trade/finance committees within 48 hours; must hold hearings and fast votes within 15–30 days.

Chapter Four: Judicial Review

Article 9 [Judicial Jurisdiction] The Court of International Trade (CIT) is the exclusive first-instance, ruling within 60 days; the Federal Circuit accelerates hearings within 30 days.

Article 10 [Review Standards] Courts only review whether exceeding authorization, whether lacking rational explanation.

Chapter Five: Supplementary Provisions

Article 11 [Coordination Clauses] This Act applies in parallel with existing laws such as 232, 301, 201; may not be substituted with IEEPA.

Article 12 [Sunset Clauses] This Act must be reviewed by Congress after five years for continuation; if not reviewed by then, it shall be extended for five years.

Drafted on September 1, 2025, in Richmond, Heart Covenant Switch Residence