“金子”意味着什么?

What Does "Gold" Mean?

“金子”意味着什么?

钱宏(Archer Hong Qian)

川普在真相平台发帖说“谁有金子,谁定规则”(THE GOLDEN RULE OF NEGOTIATING AND SUCCESS: HE WHOHAS THE GOLD MAKES THE RULES. THANK YOU!)!

这话本无错,是从一般全球化1.0到2.0的生意经实相。但是,“金子”是一个变量,所以“谁有金子”的金子,并不是一个常量,这就意味着谁“定”规则就不“一定”。

比如中国在过去二十多年里,利用“罗得里克悖论”(自由贸易、国家主权、民主人权三者不可能兼备),发挥“举国体制比较优势”和“自由贸易”规则漏洞,牺牲“民主人权”及环境资源,大力发展制造业以低于自由市场价格的廉价产品和服务,占据了“经常账户”产业链、供应链强势,也在超级“顺差”中赚取了“资本账户”的优势,成为美国仅次于日本的“大债主”(即成为“有金子”的那个“谁”)了!这没什么不愿承认的。

而美国的经常账户几乎“亏空”,且资本账户也只能以“美债”的方式显现优势,出现了美国历史上的超级“逆差”,仅在“金融账户”上占有最大优势,这样一来,美国引领定下的“WTO自由贸易规则”,就失灵了。

这就是“特利芬难题"!

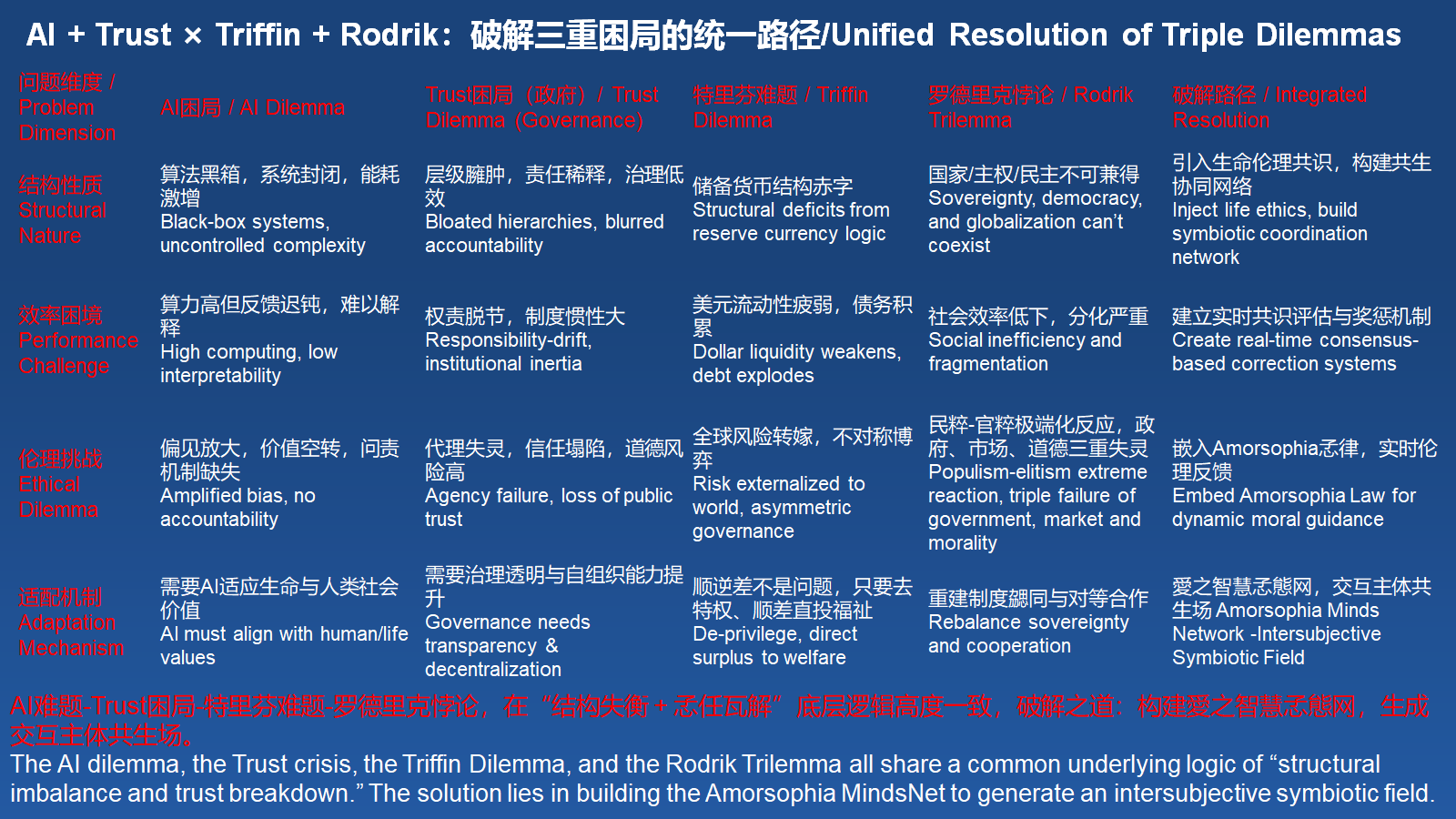

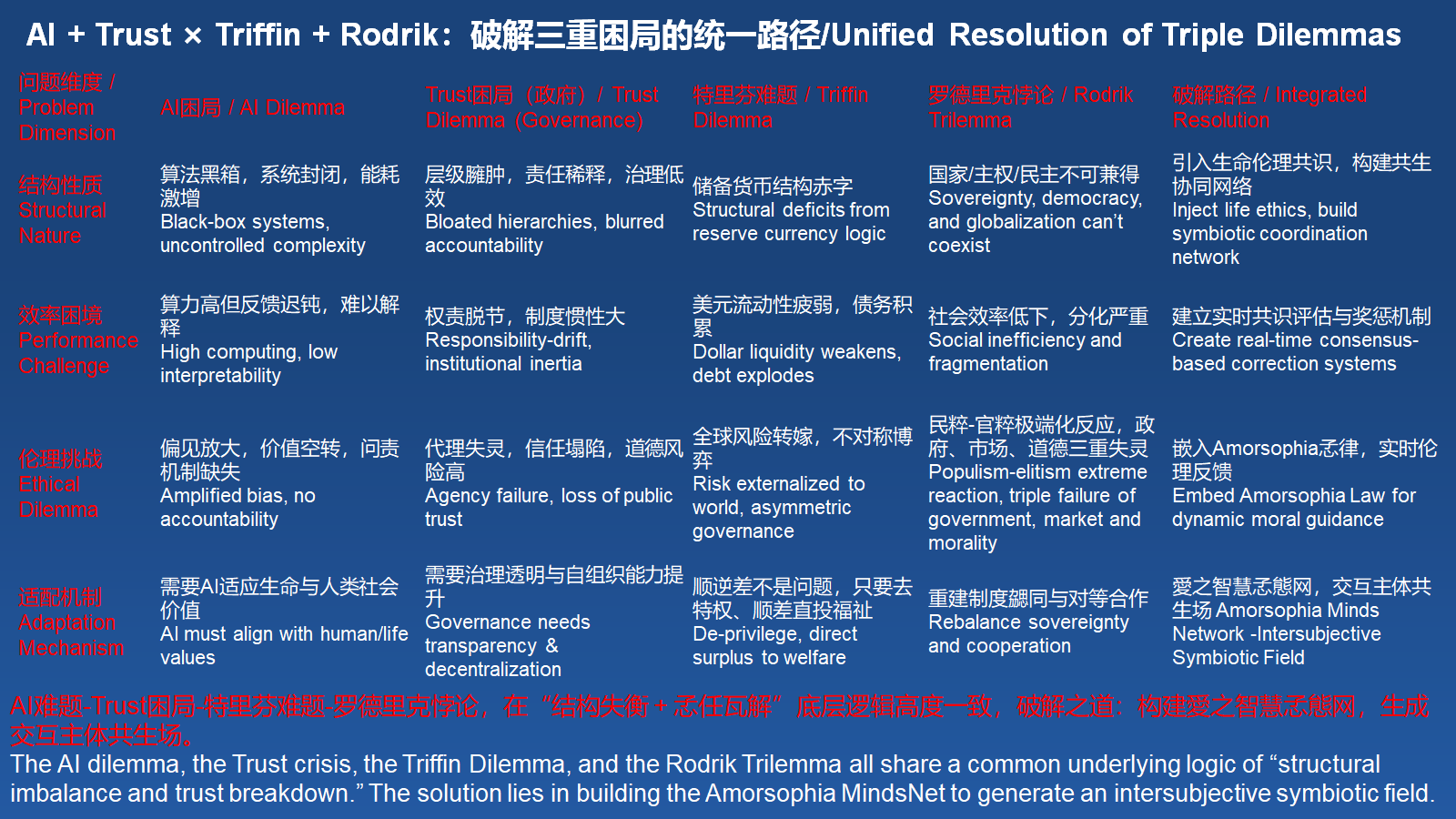

但仅仅看到这里,还远远不够,而必须从“特利芬-蒙代尔-罗德里克”三重悖论的叠加效应中,发现经济全球化(2.0)定下的规则,已经走到了尽头。 所以,我写下《<米兰报告>的缺憾:川普对等关税与全球化3.0的责任召唤——共生思维:破解“特里芬难题”ד罗德里克悖论”双重张力(The Shortcomings of the Milan Report: Trump’s Reciprocal Tariffs and the Responsibility Awakening of Globalization 3.0—Symbiotic Minds: Navigating the Dual Tensions of the “Triffin Dilemma” and the “Rodrik Trilemma”》(参看http://symbiosism.com.cn/9995.html )

那么怎么办?这事还得从货币(金子)的本质说起,也就是“金子意味着什么?”

根据共生经济学(Symbionomics)自然价值论与约定价值论双重价值论,生活、生产、生意中出现的货币,需要重新厘定。资源自然有用,使劳动创造使用价值成为可能;社会约定俗成,让承兑交换价值变成现实!

而作为价值承兑通用凭证的通货,无论是早期民间社区的“德币”,还是后来主权国家世界秩序的“法币”,抑或将来以区块链技术广普应用超主权共生的“数字代币”,都必须让个体或共同体服务(产品)的使用价值与交换价值可量化计算,为价值承兑提供方便,降低社会交易成本(包括自由贸易和非自由贸易)!

这也是目前国际上哪种货币会成为“硬通货”的基本标准——说是铁律也不为过。这个简单标准的背后,当然有一系列相互关联的充要条件:健全公正的法治;诚信守法的政府;全球军事投放能力;畅旺而规模足够大的消费市场(经常账户和资本账户的价值终端);深厚强大的资本市场;汇率市场化;汇兑自由化,资本自由流通;互联网开放,信息自由流通;签证开放,人口自由流通;零关税、零壁垒、零歧视三零原则,商品自由流通;投资准入,土地自由流通等制度成本——化解了庞大上层建筑与超负荷经济基础的基本矛盾!

顺便说一句,在这个意义上,美元是美国这个主权国家的法币没错,但这个法币,有不同于其他法币的特征——提供了一定程度的“超主权信用”保障(独立于美国政府的美联储,保障了既不会随意印美元,也不会随意加息或降息),从而大大降低了国际贸易的交易成本,中国过去四十年从中获益匪浅,美元外汇世界第一,也是中国在全球化2.0WTO国际舞台游刃有余的真正底气!

按理说,无论过去、现在、将来,这都是中美共生是真正的底线,而且,不管什么冠冕堂皇的理由(特别是Nationalism)搞坏中美关系,奢谈人民币国际化的人,要么是无视事实脱离实际,要么是存心不良,结果只会陷中国经济于维谷和国民生活于困境之中,让我们里子面子全输光!

但十分吊诡的是,自从放弃“韬光养晦”,要“有所作为”之后,这个底线,硬生生是没有守住,也许压根儿就不满足守这个共生底线!

不好意思,又言必称共生了!

不过,撇开2018年以来的所谓“贸易战”及今天终于聚焦于“关税战”(经济学家赵晓揭示“鸦片战争”其实是中国参与的第一次“贸易战”),以重新定规则,我坚持认为,经济学基础理论,确实该改写了,货币既体现了一种债权债务关系,又是社会性价值的约定和践约关系。

货币本身并不创造价值,但能够帮助使用价值承兑通用凭证的法权人,实现其使用价值和交换价值,而a Beautiful Mind之人,则创造新的价值。

从经济增长黄金率(菲尔普斯,2006),到经济健康黄金率(Archer Hong Qian,2014),劳动价值论-思想价值论-美智价值论,是一个自然历史过程。

自然-约定价值论,贯通劳动-创意-美智价值创造全过程,信用币-主权币-共生币,相应伴随全过程——这就从全球化2.0跃迁到全球化3.0的话题!

2025年4月22日于温哥华

What Does "Gold" Mean?

Archer Hong Qian

Donald J. Trump posted on Truth Social:"THE GOLDEN RULE OF NEGOTIATION AND SUCCESS: HE WHO HAS THE GOLD MAKES THE RULES. THANK YOU!"4.61K ReTruths 19.9K Likes Apr 20, 2025, 4:09 PM

"Whoever has the gold makes the rules!"(谁有金子,谁定规则)

Trump's statement is not fundamentally wrong; it reflects the practical reality of business dealings from Globalization 1.0 to 2.0.

However, "gold" is a variable, meaning the "gold" in "whoever has the gold" is not a constant. This implies that the one who "makes" the rules is not necessarily fixed. For example, over the past two decades, China has leveraged the "Rodrik Trilemma" (the impossibility of simultaneously achieving free trade, national sovereignty, and democratic human rights) by exploiting the comparative advantages of its state-led system and loopholes in free trade rules. By sacrificing democratic human rights and environmental resources, China aggressively developed its manufacturing sector, offering low-cost products and services below free market prices. This allowed China to dominate the current account in industrial and supply chains while also gaining an advantage in the capital account, making it the second-largest creditor to the U.S. after Japan (i.e., becoming the "who" that "has the gold")!

Meanwhile, the U.S. has a nearly depleted current account, and its capital account advantage is primarily manifested through U.S. Treasury bonds, with its greatest strength lying in the financial account. As a result, the WTO free trade rules established under U.S. leadership have become ineffective. This is the Triffin Dilemma!

But this observation alone is far from sufficient. We must also recognize that the rules set by economic globalization (2.0) have reached their limit, as seen through the compounded effects of the Triffin-Mundell-Rodrik trilemma. Therefore, I wrote The Shortcomings of the Milan Report: Trump’s Reciprocal Tariffs and the Responsibility Awakening of Globalization 3.0—Symbiotic Minds: Navigating the Dual Tensions of the “Triffin Dilemma” and the “Rodrik Trilemma” (see http://symbiosism.com.cn/9995.html).

So, what can be done? We need to start by examining the essence of currency (such as gold).

According to the dual value theory of Symbionomics(共生经济学)—combining natural value theory and conventional value theory—the currency that appears in daily life, production, and business needs to be redefined.

Resources are naturally useful, enabling labor to create use value, while social conventions make exchange value a reality!

As a universal voucher for value acceptance, currency—whether it’s the early community-based "virtue coins," the later sovereign fiat currency of the world order, or the future blockchain-based digital tokens for supra-sovereign symbiosis—must allow the use value and exchange value of an individual or community's services (products) to be quantifiable. This facilitates value acceptance and reduces social transaction costs (including both free trade and non-free trade)!

This is also the basic standard for determining which currency becomes a "hard currency" internationally—it could even be called an iron rule. Behind this simple standard lies a series of interrelated necessary and sufficient conditions: a sound and just legal system; an honest and law-abiding government; global military projection capabilities; a robust and sufficiently large consumer market (the value endpoint of current and capital accounts); a deep and powerful capital market; market-driven exchange rates; free currency exchange and capital flow; an open internet with free information flow; open visa policies with free population movement; the "three zeros" principle (zero tariffs, zero barriers, zero discrimination) for free commodity circulation; investment access and free land circulation—all of which resolve the fundamental contradiction between a massive superstructure and an overburdened economic base!

Symbiotic Minds: Resolving the Triffin-Rodrik Trilemma

In this sense, the U.S. dollar is indeed the fiat currency of the sovereign United States, but it has a characteristic that sets it apart from other fiat currencies—it provides a certain degree of supra-sovereign credit assurance (the Federal Reserve, independent of the U.S. government, ensures that dollars are not printed arbitrarily, nor are interest rates raised or lowered recklessly), significantly reducing the transaction costs of international trade. China has greatly benefited from this over the past four decades, and the dollar's status as the world's leading foreign exchange reserve has been the real foundation for China's ability to navigate the WTO international stage with ease during Globalization 2.0!

Logically, this should be the true bottom line for U.S.-China symbiosis—past, present, and future. Regardless of any grandiose justifications (especially nationalism), those who damage U.S.-China relations while dreaming of RMB internationalization are either ignoring reality or acting with ill intent. The result will only be to trap China’s economy in a dilemma and its people in hardship, causing us to lose both substance and face! Ironically, since abandoning the strategy of "keeping a low profile" in favor of "being more proactive," this bottom line has not been maintained, and there has even been a complete unwillingness to uphold this symbiotic bottom line!

Apologies for constantly mentioning symbiosis again!

However, setting aside the so-called "trade war" since 2018 and the current focus on a "tariff war" (economists point out that the "chip war" was actually China’s first "trade war"), I firmly believe that the foundational theories of economics need to be rewritten. Currency embodies both a creditor-debtor relationship and a social contract for value agreement and fulfillment.

Currency itself does not create value, but it enables the legal holder of a universal voucher for value acceptance to realize its use value and exchange value, while a Beautiful Mind creates new value.

From the Golden Rule of Economic Growth (Phelps, 2006) to the Golden Rule of Economic Health (Archer Hong Qian, 2014), the progression from Labor Value Theory to Thought Value Theory to Aesthetic-Intelligence Value Theory is a natural historical process.

The Natural-Conventional Value Theory runs through the entire process of value creation via labor, creativity, and aesthetic intelligence, accompanied by credit currency, sovereign currency, and symbiotic currency throughout the process—this marks the transition from Globalization 2.0 to Globalization 3.0!

April 22, 2025, Vancouver